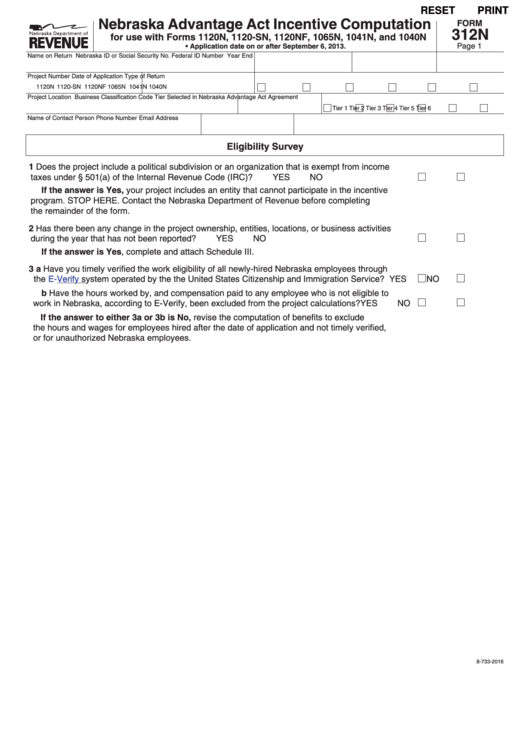

RESET

PRINT

Nebraska Advantage Act Incentive Computation

FORM

312N

for use with Forms 1120N, 1120-SN, 1120NF, 1065N, 1041N, and 1040N

Page 1

• Application date on or after September 6, 2013.

Name on Return

Nebraska ID or Social Security No. Federal ID Number

Year End

Project Number

Date of Application

Type of Return

1120N

1120-SN

1120NF

1065N

1041N

1040N

Project Location

Business Classification Code Tier Selected in Nebraska Advantage Act Agreement

Tier 1

Tier 2

Tier 3

Tier 4

Tier 5

Tier 6

Name of Contact Person

Phone Number

Email Address

Eligibility Survey

1 Does the project include a political subdivision or an organization that is exempt from income

taxes under § 501(a) of the Internal Revenue Code (IRC)? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

If the answer is Yes, your project includes an entity that cannot participate in the incentive

program. STOP HERE. Contact the Nebraska Department of Revenue before completing

the remainder of the form.

2 Has there been any change in the project ownership, entities, locations, or business activities

during the year that has not been reported? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YES

NO

If the answer is Yes, complete and attach Schedule III.

3 a Have you timely verified the work eligibility of all newly-hired Nebraska employees through

the

E-Verify

system operated by the the United States Citizenship and Immigration Service?

YES

NO

b Have the hours worked by, and compensation paid to any employee who is not eligible to

work in Nebraska, according to E-Verify, been excluded from the project calculations? . . . . .

YES

NO

If the answer to either 3a or 3b is No, revise the computation of benefits to exclude

the hours and wages for employees hired after the date of application and not timely verified,

or for unauthorized Nebraska employees.

8-733-2016

1

1 2

2