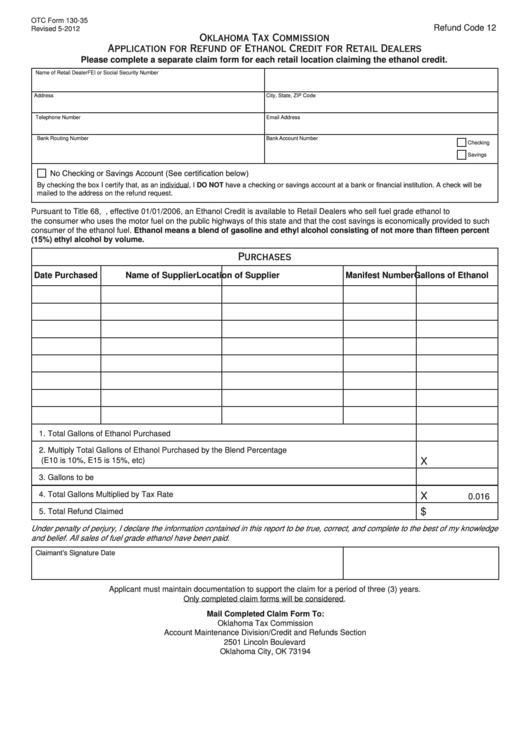

OTC Form 130-35

Refund Code 12

Revised 5-2012

Oklahoma Tax Commission

Application for Refund of Ethanol Credit for Retail Dealers

Please complete a separate claim form for each retail location claiming the ethanol credit.

Name of Retail Dealer

FEI or Social Security Number

Address

City, State, ZIP Code

Telephone Number

Email Address

Bank Routing Number

Bank Account Number

Checking

Savings

No Checking or Savings Account (See certification below)

By checking the box I certify that, as an individual, I DO NOT have a checking or savings account at a bank or financial institution. A check will be

mailed to the address on the refund request.

Pursuant to Title 68, O.S. 500.10-1, effective 01/01/2006, an Ethanol Credit is available to Retail Dealers who sell fuel grade ethanol to

the consumer who uses the motor fuel on the public highways of this state and that the cost savings is economically provided to such

consumer of the ethanol fuel. Ethanol means a blend of gasoline and ethyl alcohol consisting of not more than fifteen percent

(15%) ethyl alcohol by volume.

Purchases

Date Purchased

Name of Supplier

Location of Supplier

Manifest Number Gallons of Ethanol

1.

Total Gallons of Ethanol Purchased ...........................................................................................................

2.

Multiply Total Gallons of Ethanol Purchased by the Blend Percentage

(E10 is 10%, E15 is 15%, etc) ....................................................................................................................

X

3.

Gallons to be Refunded..............................................................................................................................

4.

Total Gallons Multiplied by Tax Rate ..........................................................................................................

X

0.016

$

5.

Total Refund Claimed .................................................................................................................................

Under penalty of perjury, I declare the information contained in this report to be true, correct, and complete to the best of my knowledge

and belief. All sales of fuel grade ethanol have been paid.

Claimant’s Signature

Date

Applicant must maintain documentation to support the claim for a period of three (3) years.

Only completed claim forms will be considered.

Mail Completed Claim Form To:

Oklahoma Tax Commission

Account Maintenance Division/Credit and Refunds Section

2501 Lincoln Boulevard

Oklahoma City, OK 73194

1

1