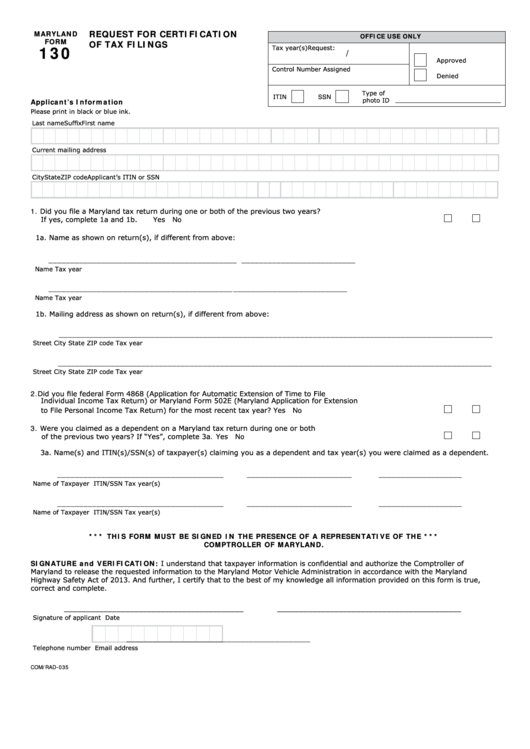

REQUEST FOR CERTIFICATION

MARYLAND

OFFICE USE ONLY

FORM

OF TAX FILINGS

130

Tax year(s)

Request:

/

Approved

Control Number Assigned

Denied

Type of

ITIN

SSN

photo ID

Applicant’s Information

Please print in black or blue ink.

Last name

Suffix

First name

M.I.

Current mailing address

City

State

ZIP code

Applicant’s ITIN or SSN

1. Did you file a Maryland tax return during one or both of the previous two years?

If yes, complete 1a and 1b. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

1a. Name as shown on return(s), if different from above:

___________________________________________

__________________________

Name

Tax year

__________________________________________

__________________________

Name

Tax year

1b. Mailing address as shown on return(s), if different from above:

___________________________________________________________________________________________________

Street

City

State

ZIP code

Tax year

___________________________________________________________________________________________________

Street

City

State

ZIP code

Tax year

2. Did you file federal Form 4868 (Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return) or Maryland Form 502E (Maryland Application for Extension

to File Personal Income Tax Return) for the most recent tax year? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3. Were you claimed as a dependent on a Maryland tax return during one or both

of the previous two years? If “Yes”, complete 3a. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

3a. Name(s) and ITIN(s)/SSN(s) of taxpayer(s) claiming you as a dependent and tax year(s) you were claimed as a dependent.

______________________________________

________________________

___________________

Name of Taxpayer

ITIN/SSN

Tax year(s)

______________________________________

________________________

___________________

Name of Taxpayer

ITIN/SSN

Tax year(s)

*** THIS FORM MUST BE SIGNED IN THE PRESENCE OF A REPRESENTATIVE OF THE ***

COMPTROLLER OF MARYLAND.

SIGNATURE and VERIFICATION: I understand that taxpayer information is confidential and authorize the Comptroller of

Maryland to release the requested information to the Maryland Motor Vehicle Administration in accordance with the Maryland

Highway Safety Act of 2013. And further, I certify that to the best of my knowledge all information provided on this form is true,

correct and complete.

_________________________________________

__________________________________________

Signature of applicant

Date

__________________________________________

Telephone number

Email address

COM/RAD-035

1

1 2

2