MF-113: Invoice Requirements

For assistance:

You may access the department’s web site 24 hours a day, seven

(for the motor vehicle fuel tax refund law)

days a week at From this web site you can:

Invoices submitted with any of the following

• Complete electronic fill-in forms.

motor vehicle fuel tax refund claims must

• Download froms, schedules, instructions, and publications.

comply with the Wisconsin fuel tax refund

• View answers to common questions.

law and administrative rules. (See Sections

• E-mail us for assistance.

78.20 (Retailer Refunds) and 78.75 (Taxicab &

Off-Road Refunds), Wis. Stats., for additional

* Access My Tax Account.

information regarding motor fuel refunds).

Phone: (608) 266-0064 or 266-3223

Types of Refund Claims

Fax: (608) 261-7049

E-mail: excise@dor.state

MF-001

Taxicab Claim

MF-003

Agricultural Off-Road Claim

MF-004

Retailer Claim (gasoline only)

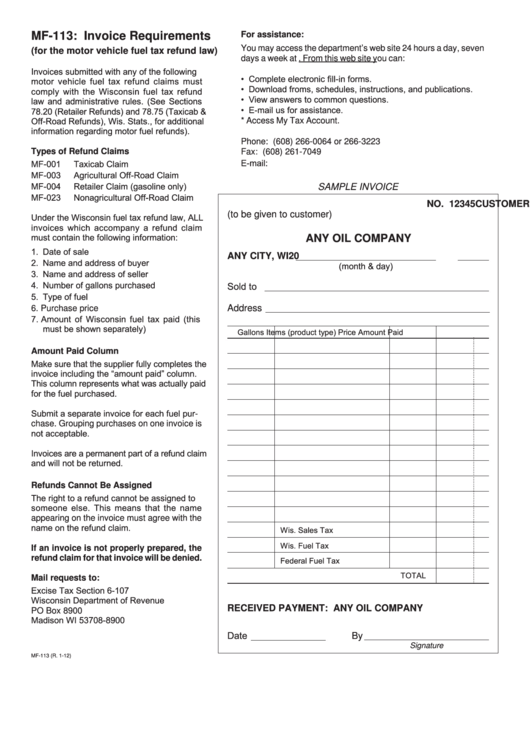

SAMPLE INVOICE

MF-023

Nonagricultural Off-Road Claim

CUSTOMER’S INVOICE

NO. 12345

(to be given to customer)

Under the Wisconsin fuel tax refund law, ALL

invoices which accompany a refund claim

must contain the following information:

ANY OIL COMPANY

1. Date of sale

ANY CITY, WI

20

2. Name and address of buyer

(month & day)

3. Name and address of seller

4. Number of gallons purchased

Sold to

5. Type of fuel

6. Purchase price

Address

7. Amount of Wisconsin fuel tax paid (this

must be shown separately)

Gallons

Items (product type)

Price

Amount Paid

Amount Paid Column

Make sure that the supplier fully completes the

invoice including the “amount paid” column.

This column represents what was actually paid

for the fuel purchased.

Submit a separate invoice for each fuel pur-

chase. Grouping purchases on one invoice is

not acceptable.

Invoices are a permanent part of a refund claim

and will not be returned.

Refunds Cannot Be Assigned

The right to a refund cannot be assigned to

someone else. This means that the name

appearing on the invoice must agree with the

name on the refund claim.

Wis. Sales Tax

Wis. Fuel Tax

If an invoice is not properly prepared, the

refund claim for that invoice will be denied.

Federal Fuel Tax

TOTAL

Mail requests to:

Excise Tax Section 6-107

Wisconsin Department of Revenue

RECEIVED PAYMENT: ANY OIL COMPANY

PO Box 8900

Madison WI 53708-8900

Date

By

Signature

MF-113 (R. 1-12)

1

1