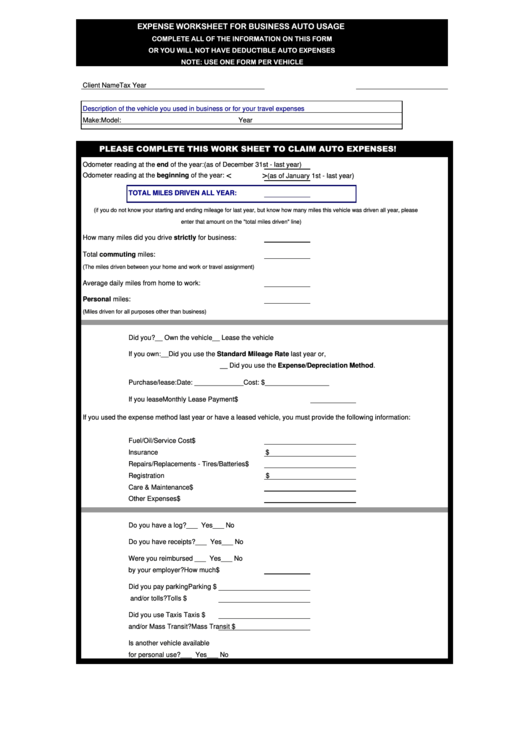

Expense Worksheet For Business Auto Usage

ADVERTISEMENT

Client Name

Tax Year

Description of the vehicle you used in business or for your travel expenses

Make:

Model:

Year

Odometer reading at the end of the year:

(as of December 31st - last year)

<

>

Odometer reading at the beginning of the year:

(as of January 1st - last year)

TOTAL MILES DRIVEN ALL YEAR:

(if you do not know your starting and ending mileage for last year, but know how many miles this vehicle was driven all year, please

enter that amount on the "total miles driven" line)

How many miles did you drive strictly for business:

Total commuting miles:

(The miles driven between your home and work or travel assignment)

Average daily miles from home to work:

Personal miles:

(Miles driven for all purposes other than business)

Did you?

__ Own the vehicle

__ Lease the vehicle

If you own:

__Did you use the Standard Mileage Rate last year or,

__ Did you use the Expense/Depreciation Method.

Purchase/lease:

Date: _____________

Cost: $_________________

If you lease

Monthly Lease Payment

$

If you used the expense method last year or have a leased vehicle, you must provide the following information:

Fuel/Oil/Service Cost

$

Insurance

$

Repairs/Replacements - Tires/Batteries

$

Registration

$

Care & Maintenance

$

Other Expenses

$

Do you have a log?

___ Yes

___ No

Do you have receipts?

___ Yes

___ No

Were you reimbursed

___ Yes

___ No

by your employer?

How much

$

Did you pay parking

Parking $

and/or tolls?

Tolls $

Did you use Taxis

Taxis $

and/or Mass Transit?

Mass Transit $

Is another vehicle available

for personal use?

___ Yes

___ No

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1