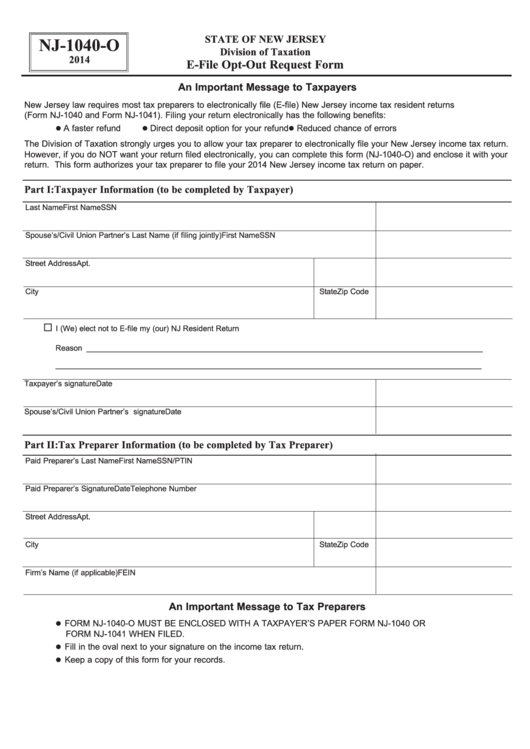

STATE OF NEW JERSEY

NJ-1040-O

Division of Taxation

2014

E-File Opt-Out Request Form

An Important Message to Taxpayers

New Jersey law requires most tax preparers to electronically file (E-file) New Jersey income tax resident returns

(Form NJ-1040 and Form NJ-1041). Filing your return electronically has the following benefits:

l

l

l

A faster refund

Direct deposit option for your refund

Reduced chance of errors

The Division of Taxation strongly urges you to allow your tax preparer to electronically file your New Jersey income tax return.

However, if you do NOT want your return filed electronically, you can complete this form (NJ-1040-O) and enclose it with your

return. This form authorizes your tax preparer to file your 2014 New Jersey income tax return on paper.

Part I:

Taxpayer Information (to be completed by Taxpayer)

Last Name

First Name

SSN

Spouse’s/Civil Union Partner’s Last Name (if filing jointly)

First Name

SSN

Street Address

Apt. no.

Telephone Number

City

State

Zip Code

¨

I (We) elect not to E-file my (our) NJ Resident Return

Reason _____________________________________________________________________________________________

____________________________________________________________________________________________________

Taxpayer’s signature

Date

Spouse’s/Civil Union Partner’s signature

Date

Part II:

Tax Preparer Information (to be completed by Tax Preparer)

Paid Preparer’s Last Name

First Name

SSN/PTIN

Paid Preparer’s Signature

Date

Telephone Number

Street Address

Apt. no.

Email Address

City

State

Zip Code

Firm’s Name (if applicable)

FEIN

An Important Message to Tax Preparers

l

FORM NJ-1040-O MUST BE ENCLOSED WITH A TAXPAYER’S PAPER FORM NJ-1040 OR

FORM NJ-1041 WHEN FILED.

l

Fill in the oval next to your signature on the income tax return.

l

Keep a copy of this form for your records.

1

1