Reset Form

Print Form

Iowa Department of Revenue

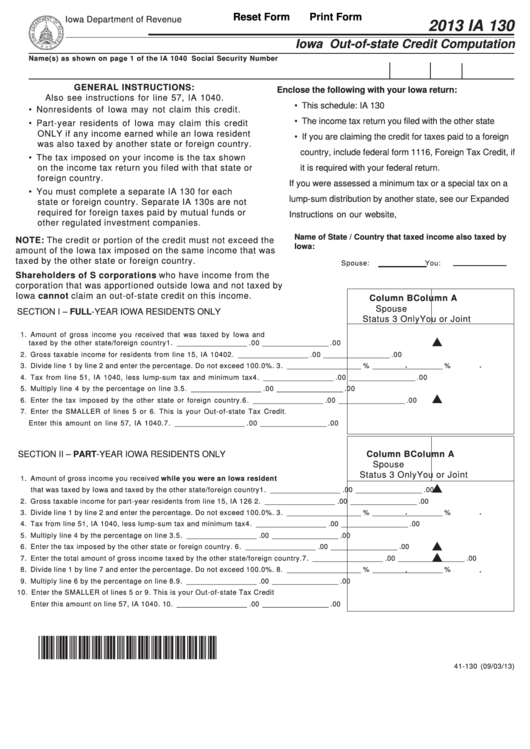

2013 IA 130

Iowa Out-of-state Credit Computation

Name(s) as shown on page 1 of the IA 1040

Social Security Number

GENERAL INSTRUCTIONS:

Enclose the following with your Iowa return:

Also see instructions for line 57, IA 1040.

• This schedule: IA 130

• Nonresidents of Iowa may not claim this credit.

• The income tax return you filed with the other state

• Part-year residents of Iowa may claim this credit

ONLY if any income earned while an Iowa resident

• If you are claiming the credit for taxes paid to a foreign

was also taxed by another state or foreign country.

country, include federal form 1116, Foreign Tax Credit, if

• The tax imposed on your income is the tax shown

on the income tax return you filed with that state or

it is required with your federal return.

foreign country.

If you were assessed a minimum tax or a special tax on a

• You must complete a separate IA 130 for each

lump-sum distribution by another state, see our Expanded

state or foreign country. Separate IA 130s are not

required for foreign taxes paid by mutual funds or

Instructions on our website,

other regulated investment companies.

Name of State / Country that taxed income also taxed by

NOTE: The credit or portion of the credit must not exceed the

Iowa:

amount of the Iowa tax imposed on the same income that was

taxed by the other state or foreign country.

Spouse:

You:

Shareholders of S corporations who have income from the

corporation that was apportioned outside Iowa and not taxed by

Iowa cannot claim an out-of-state credit on this income.

Column B

Column A

Spouse

SECTION I – FULL-YEAR IOWA RESIDENTS ONLY

Status 3 Only

You or Joint

1. Amount of gross income you received that was taxed by Iowa and

L

taxed by the other state/foreign country ......................................................................................... 1. __________________ .00 _________________ .00

2. Gross taxable income for residents from line 15, IA 1040 ......................................................... 2. __________________ .00 _________________ .00

.

.

3. Divide line 1 by line 2 and enter the percentage. Do not exceed 100.0%. ................................ 3. ___________________ % __________________ %

4. Tax from line 51, IA 1040, less lump-sum tax and minimum tax ........................................... 4. __________________ .00 _________________ .00

5. Multiply line 4 by the percentage on line 3. ................................................................................. 5. __________________ .00 _________________ .00

L

6. Enter the tax imposed by the other state or foreign country. ................................................ 6. __________________ .00 _________________ .00

7. Enter the SMALLER of lines 5 or 6. This is your Out-of-state Tax Credit.

Enter this amount on line 57, IA 1040. ......................................................................................... 7. __________________ .00 _________________ .00

SECTION II – PART-YEAR IOWA RESIDENTS ONLY

Column B

Column A

Spouse

Status 3 Only

You or Joint

1. Amount of gross income you received while you were an Iowa resident

L

that was taxed by Iowa and taxed by the other state/foreign country ........................................ 1. __________________ .00 _________________ .00

2. Gross taxable income for part-year residents from line 15, IA 126 ............................................ 2. __________________ .00 _________________ .00

.

.

3. Divide line 1 by line 2 and enter the percentage. Do not exceed 100.0%. ................................ 3. ___________________ % __________________ %

4. Tax from line 51, IA 1040, less lump-sum tax and minimum tax ................................................ 4. __________________ .00 _________________ .00

5. Multiply line 4 by the percentage on line 3. .................................................................................... 5. __________________ .00 _________________ .00

L

6. Enter the tax imposed by the other state or foreign country. ...................................................... 6. __________________ .00 _________________ .00

L

7. Enter the total amount of gross income taxed by the other state/foreign country. .................. 7. __________________ .00 _________________ .00

.

.

8. Divide line 1 by line 7 and enter the percentage. Do not exceed 100.0%. ................................ 8. ___________________ % __________________ %

9. Multiply line 6 by the percentage on line 8. .................................................................................... 9. __________________ .00 _________________ .00

10. Enter the SMALLER of lines 5 or 9. This is your Out-of-state Tax Credit

Enter this amount on line 57, IA 1040. .......................................................................................... 10. __________________ .00 _________________ .00

*1341130019999*

41-130 (09/03/13)

1

1