Form Mf-207 - Certificate Of Authorization For Bulk Alternate Fuel Purchasers

ADVERTISEMENT

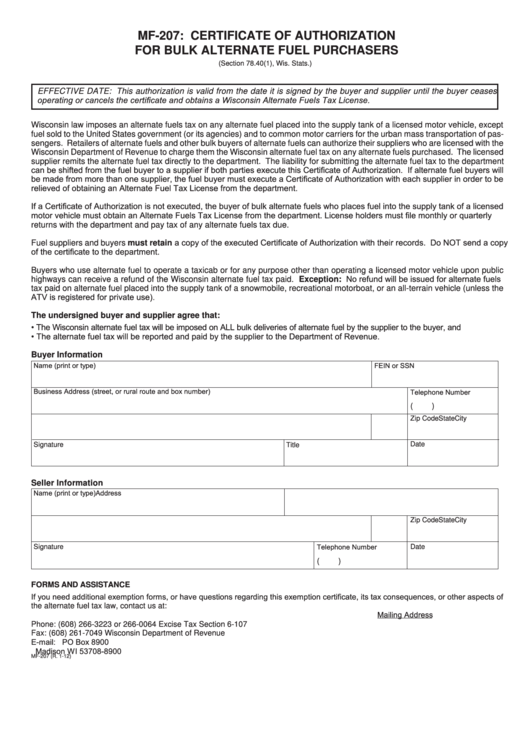

MF-207: CERTIFICATE OF AUTHORIZATION

FOR BULK ALTERNATE FUEL PURCHASERS

(Section 78.40(1), Wis. Stats.)

EFFECTIVE DATE: This authorization is valid from the date it is signed by the buyer and supplier until the buyer ceases

operating or cancels the certificate and obtains a Wisconsin Alternate Fuels Tax License.

Wisconsin law imposes an alternate fuels tax on any alternate fuel placed into the supply tank of a licensed motor vehicle, except

fuel sold to the United States government (or its agencies) and to common motor carriers for the urban mass transportation of pas-

sengers. Retailers of alternate fuels and other bulk buyers of alternate fuels can authorize their suppliers who are licensed with the

Wisconsin Department of Revenue to charge them the Wisconsin alternate fuel tax on any alternate fuels purchased. The licensed

supplier remits the alternate fuel tax directly to the department. The liability for submitting the alternate fuel tax to the department

can be shifted from the fuel buyer to a supplier if both parties execute this Certificate of Authorization. If alternate fuel buyers will

be made from more than one supplier, the fuel buyer must execute a Certificate of Authorization with each supplier in order to be

relieved of obtaining an Alternate Fuel Tax License from the department.

If a Certificate of Authorization is not executed, the buyer of bulk alternate fuels who places fuel into the supply tank of a licensed

motor vehicle must obtain an Alternate Fuels Tax License from the department. License holders must file monthly or quarterly

returns with the department and pay tax of any alternate fuels tax due.

Fuel suppliers and buyers must retain a copy of the executed Certificate of Authorization with their records. Do NOT send a copy

of the certificate to the department.

Buyers who use alternate fuel to operate a taxicab or for any purpose other than operating a licensed motor vehicle upon public

highways can receive a refund of the Wisconsin alternate fuel tax paid. Exception: No refund will be issued for alternate fuels

tax paid on alternate fuel placed into the supply tank of a snowmobile, recreational motorboat, or an all-terrain vehicle (unless the

ATV is registered for private use).

The undersigned buyer and supplier agree that:

•

The Wisconsin alternate fuel tax will be imposed on ALL bulk deliveries of alternate fuel by the supplier to the buyer, and

•

The alternate fuel tax will be reported and paid by the supplier to the Department of Revenue.

Buyer Information

Name (print or type)

FEIN or SSN

Business Address (street, or rural route and box number)

Telephone Number

(

)

City

State

Zip Code

Date

Signature

Title

Seller Information

Name (print or type)

Address

City

State

Zip Code

Telephone Number

Signature

Date

(

)

FORMS AND ASSISTANCE

If you need additional exemption forms, or have questions regarding this exemption certificate, its tax consequences, or other aspects of

the alternate fuel tax law, contact us at:

Mailing Address

Phone: (608) 266-3223 or 266-0064

Excise Tax Section 6-107

Fax:

(608) 261-7049

Wisconsin Department of Revenue

E-mail: excise@revenue.wi.gov

PO Box 8900

Madison WI 53708-8900

MF-207 (R. 1-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1