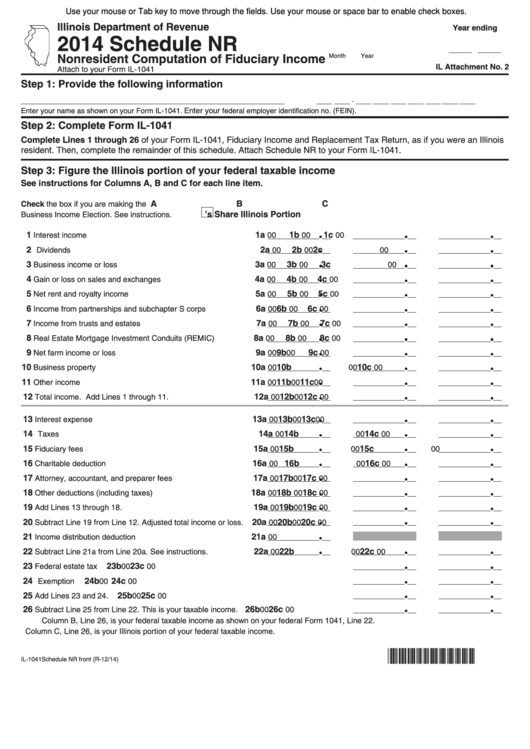

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Year ending

2014 Schedule NR

Nonresident Computation of Fiduciary Income

Month

Year

IL Attachment No. 2

Attach to your Form IL-1041

Step 1: Provide the following information

Enter your

Enter your name as shown on your Form IL-1041.

federal employer identification no. (FEIN).

Step 2: Complete Form IL-1041

Complete Lines 1 through 26 of your Form IL-1041, Fiduciary Income and Replacement Tax Return, as if you were an Illinois

resident. Then, complete the remainder of this schedule. Attach Schedule NR to your Form IL-1041.

Step 3: Figure the Illinois portion of your federal taxable income

See instructions for Columns A, B and C for each line item.

A

B

C

Check the box if you are making the

U.S. Form 1041

Fiduciary’s Share

Illinois Portion

Business Income Election. See instructions.

1

1a

1b

1c

Interest income

00

00

00

2

2a

2b

2c

Dividends

00

00

00

3

3a

3b

3c

Business income or loss

00

00

00

4

4a

4b

4c

Gain or loss on sales and exchanges

00

00

00

5

5a

5b

5c

Net rent and royalty income

00

00

00

6

6a

6b

6c

Income from partnerships and subchapter S corps

00

00

00

7

7a

7b

7c

Income from trusts and estates

00

00

00

8

8a

8b

8c

Real Estate Mortgage Investment Conduits (REMIC)

00

00

00

9

9a

9b

9c

Net farm income or loss

00

00

00

10

10a

10b

10c

Business property

00

00

00

11

11a

11b

11c

Other income

00

00

00

12

12a

12b

12c

Total income. Add Lines 1 through 11.

00

00

00

13

13a

13b

13c

Interest expense

00

00

00

14

14a

14b

14c

Taxes

00

00

00

15

15a

15b

15c

Fiduciary fees

00

00

00

16

16a

16b

16c

Charitable deduction

00

00

00

17

17a

17b

17c

Attorney, accountant, and preparer fees

00

00

00

18

18a

18b

18c

Other deductions (including taxes)

00

00

00

19

19a

19b

19c

Add Lines 13 through 18.

00

00

00

20

20a

20b

20c

Subtract Line 19 from Line 12. Adjusted total income or loss.

00

00

00

21

21a

Income distribution deduction

00

22

22a

22b

22c

Subtract Line 21a from Line 20a. See instructions.

00

00

00

23

23b

23c

Federal estate tax

00

00

24

24b

24c

Exemption

00

00

25

25b

25c

Add Lines 23 and 24.

00

00

26

26b

26c

Subtract Line 25 from Line 22. This is your taxable income.

00

00

Column B, Line 26, is your federal taxable income as shown on your federal Form 1041, Line 22.

Column C, Line 26, is your Illinois portion of your federal taxable income.

*463801110*

IL-1041Schedule NR front (R-12/14)

1

1 2

2