Form Et-500 - Generation-Skipping Transfer Tax Return For Distributions

ADVERTISEMENT

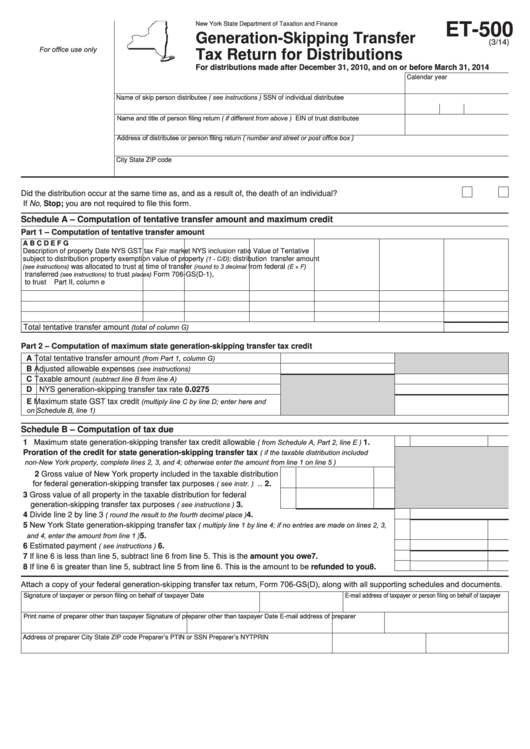

ET-500

New York State Department of Taxation and Finance

Generation-Skipping Transfer

(3/14)

For office use only

Tax Return for Distributions

For distributions made after December 31, 2010, and on or before March 31, 2014

Calendar year

Name of skip person distributee ( see instructions )

SSN of individual distributee

Name and title of person filing return ( if different from above )

EIN of trust distributee

Address of distributee or person filing return ( number and street or post office box )

City

State

ZIP code

Did the distribution occur at the same time as, and as a result of, the death of an individual? ............................................... Yes

No

If No, Stop; you are not required to file this form.

Schedule A – Computation of tentative transfer amount and maximum credit

Part 1 – Computation of tentative transfer amount

A

B

C

D

E

F

G

Description of property

Date

NYS GST tax

Fair market

NYS inclusion ratio

Value of

Tentative

(1 - C/D);

subject to distribution

property

exemption

value of property

distribution

transfer amount

(see instructions)

(round to 3 decimal

(E × F)

was

allocated to trust

at time of transfer

from federal

(see instructions)

places)

transferred

to trust

Form 706-GS(D-1),

to trust

Part II, column e

(total of column G)

Total tentative transfer amount

..........................................................................................................................

Part 2 – Computation of maximum state generation-skipping transfer tax credit

(from Part 1, column G)

A Total tentative transfer amount

.........................

(see instructions)

B Adjusted allowable expenses

....................................

(subtract line B from line A)

C Taxable amount

...........................................

D NYS generation-skipping transfer tax rate ..........................................

.

0

0275

(multiply line C by line D; enter here and

E Maximum state GST tax credit

on Schedule B, line 1)

..........................................................................

Schedule B – Computation of tax due

1 Maximum state generation-skipping transfer tax credit allowable

( from Schedule A, Part 2, line E )

...............

1.

( if the taxable distribution included

Proration of the credit for state generation-skipping transfer tax

non-New York property, complete lines 2, 3, and 4; otherwise enter the amount from line 1 on line 5 )

2 Gross value of New York property included in the taxable distribution

for federal generation-skipping transfer tax purposes

( see instr. )

..

2.

3 Gross value of all property in the taxable distribution for federal

generation-skipping transfer tax purposes

( see instructions )

..........

3.

( round the result to the fourth decimal place )

4 Divide line 2 by line 3

.............................................................

4.

5 New York State generation-skipping transfer tax

( multiply line 1 by line 4; if no entries are made on lines 2, 3,

and 4, enter the amount from line 1 )

..............................................................................................................

5.

( see instructions )

6 Estimated payment

...........................................................................................................

6.

7 If line 6 is less than line 5, subtract line 6 from line 5. This is the amount you owe ..................................

7.

8 If line 6 is greater than line 5, subtract line 5 from line 6. This is the amount to be refunded to you ........

8.

Attach a copy of your federal generation-skipping transfer tax return, Form 706-GS(D), along with all supporting schedules and documents.

Signature of taxpayer or person filing on behalf of taxpayer

Date

E-mail address of taxpayer or person filing on behalf of taxpayer

Print name of preparer other than taxpayer

Signature of preparer other than taxpayer

Date

E-mail address of preparer

Address of preparer

City

State ZIP code

Preparer’s PTIN or SSN

Preparer’s NYTPRIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4