Schedules M-N (Form Et-90.4) - New York State Estate Tax Return

ADVERTISEMENT

Click here

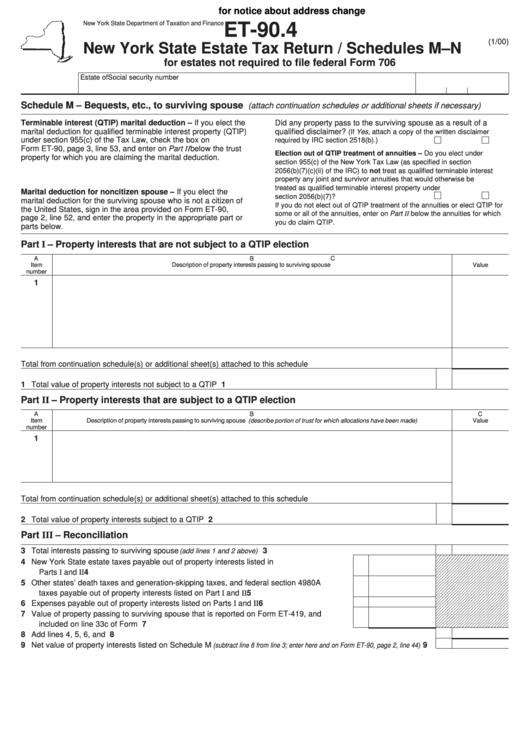

for notice about address change

New York State Department of Taxation and Finance

ET-90.4

(1/00)

New York State Estate Tax Return / Schedules M–N

for estates not required to file federal Form 706

Estate of

Social security number

Schedule M – Bequests, etc., to surviving spouse

(attach continuation schedules or additional sheets if necessary)

Terminable interest (QTIP) marital deduction – If you elect the

Did any property pass to the surviving spouse as a result of a

marital deduction for qualified terminable interest property (QTIP)

qualified disclaimer?

(If Yes, attach a copy of the written disclaimer

under section 955(c) of the Tax Law, check the box on

required by IRC section 2518(b).) ..........................

Yes

No

Form ET-90, page 3, line 53, and enter on Part II below the trust

Election out of QTIP treatment of annuities – Do you elect under

property for which you are claiming the marital deduction.

section 955(c) of the New York Tax Law (as specified in section

2056(b)(7)(c)(ii) of the IRC) to not treat as qualified terminable interest

property any joint and survivor annuities that would otherwise be

treated as qualified terminable interest property under

Marital deduction for noncitizen spouse – If you elect the

section 2056(b)(7)? ................................................

Yes

No

marital deduction for the surviving spouse who is not a citizen of

If you do not elect out of QTIP treatment of the annuities or elect QTIP for

the United States, sign in the area provided on Form ET-90,

some or all of the annuities, enter on Part II below the annuities for which

page 2, line 52, and enter the property in the appropriate part or

you do claim QTIP.

parts below.

Part I – Property interests that are not subject to a QTIP election

A

B

C

Item

Description of property interests passing to surviving spouse

Value

number

1

Total from continuation schedule(s) or additional sheet(s) attached to this schedule ................................................................

1 Total value of property interests not subject to a QTIP election ......................................................................................

1

Part II – Property interests that are subject to a QTIP election

A

B

C

Item

Description of property interests passing to surviving spouse (describe portion of trust for which allocations have been made)

Value

number

1

Total from continuation schedule(s) or additional sheet(s) attached to this schedule ................................................................

2 Total value of property interests subject to a QTIP election ............................................................................................

2

Part III – Reconciliation

3 Total interests passing to surviving spouse

..............................................................................

3

(add lines 1 and 2 above)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

4 New York State estate taxes payable out of property interests listed in

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

Parts I and II above ...............................................................................................................

4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

5 Other states’ death taxes and generation-skipping taxes, and federal section 4980A

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

taxes payable out of property interests listed on Part I and II above ....................................

5

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

6 Expenses payable out of property interests listed on Parts I and II above ..............................

6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

7 Value of property passing to surviving spouse that is reported on Form ET-419, and

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

included on line 33c of Form ET-90 .......................................................................................

7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7

8 Add lines 4, 5, 6, and 7 ...................................................................................................................................................

8

9 Net value of property interests listed on Schedule M

....

9

(subtract line 8 from line 3; enter here and on Form ET-90, page 2, line 44)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3