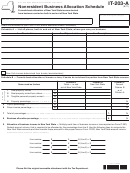

IT-203-F (11/14) (back)

Your social security number

Schedule B – Stock option, restricted stock, or stock appreciation rights allocation

(see instructions)

New York State nonresidents and part-year residents: If you received compensation from stock options, restricted stock, or

stock appreciation rights and you performed services within New York State, use this schedule to calculate your New York State

compensation attributable to those items, if the calculation requires an allocation period that is different than the period used on

Form IT-203-B.

Complete a separate Schedule B for each option, stock, or right you were granted. Use the mmddyyyy format when entering dates.

Description of stock

Grant date

Vest date

Exercise date

Allocation period

(see instructions)

to

Mark an X

in one box for

Statutory

Non-statutory

Restricted stock

Appreciation right

stock type:

3 Enter the applicable column A amount from Schedule B Table

.........................

3

(see instructions)

00

4 Enter the applicable column B amount from Schedule B Table

.........................

4

(see instructions)

00

5 Compensation to be allocated

..............................................................

5

(subtract line 4 from line 3)

00

6 Total days in allocation period ......................................................................

6

7 Saturdays and Sundays

............................

7

(not worked)

8 Holidays

.....................................................

8

(not worked)

9 Sick leave .....................................................................

9

10 Vacation ........................................................................ 10

11 Other nonworking days ................................................

11

12 Total nonworking days

............................................... 12

(add lines 7 through 11)

13 Total days worked in allocation period at this job

13

(subtract line 12 from line 6)

14 Total days included in line 13 worked outside

New York State ........................................................ 14

15 Number of days worked at home included in line 14..... 15

16 Subtract line 15 from line 14 ......................................................................... 16

17 Days worked in New York State

......................... 17

(subtract line 16 from line 13)

18 Enter number of days from line 13 above .................................................... 18

19 Divide line 17 by line 18; round the result to the fourth decimal place ........................................ 19

20 Multiply line 19 by line 5 .............................................................................................................. 20

00

Include the line 20 amount on the appropriate line of Form IT-203 in the New York State amount column.

323002140094

1

1 2

2