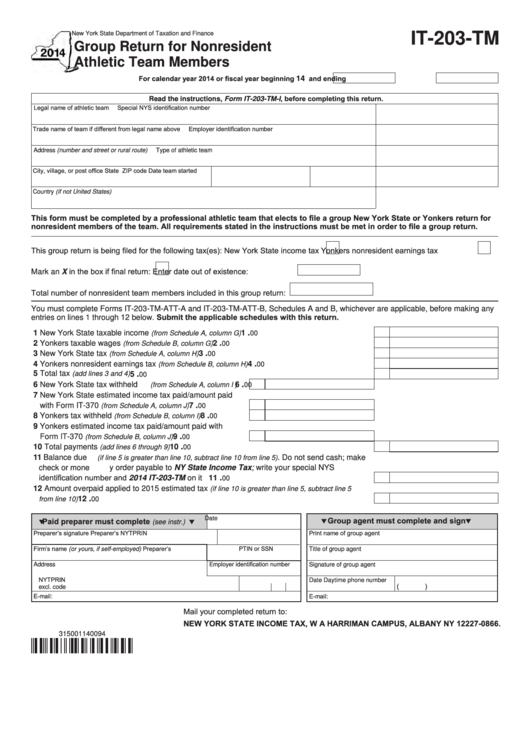

New York State Department of Taxation and Finance

IT-203-TM

Group Return for Nonresident

Athletic Team Members

For calendar year 2014 or fiscal year beginning

and ending

14

Read the instructions, Form IT-203-TM-I, before completing this return.

Legal name of athletic team

Special NYS identification number

Trade name of team if different from legal name above

Employer identification number

Address (number and street or rural route)

Type of athletic team

City, village, or post office

State

ZIP code

Date team started

Country (if not United States)

This form must be completed by a professional athletic team that elects to file a group New York State or Yonkers return for

nonresident members of the team. All requirements stated in the instructions must be met in order to file a group return.

This group return is being filed for the following tax(es): New York State income tax

Yonkers nonresident earnings tax

Mark an X in the box if final return:

Enter date out of existence:

Total number of nonresident team members included in this group return:

You must complete Forms IT-203-TM-ATT-A and IT-203-TM-ATT-B, Schedules A and B, whichever are applicable, before making any

entries on lines 1 through 12 below. Submit the applicable schedules with this return.

.

1 New York State taxable income

.......................................................

1

(from Schedule A, column G)

00

.

2 Yonkers taxable wages

...................................................................

2

(from Schedule B, column G)

00

.

3 New York State tax

..........................................................................

3

(from Schedule A, column H)

00

.

4 Yonkers nonresident earnings tax

...................................................

4

(from Schedule B, column H)

00

5 Total tax

..........................................................................................................

.

(add lines 3 and 4)

5

00

.

6 New York State tax withheld

....

6

(from Schedule A, column I )

00

7 New York State estimated income tax paid/amount paid

.

with Form IT-370

.................

7

(from Schedule A, column J)

00

.

8 Yonkers tax withheld

...............

8

(from Schedule B, column I)

00

9 Yonkers estimated income tax paid/amount paid with

.

Form IT-370

........................

9

(from Schedule B, column J)

00

.

10 Total payments

......................................................................................... 10

(add lines 6 through 9)

00

11 Balance due

. Do not send cash; make

(if line 5 is greater than line 10, subtract line 10 from line 5)

check or money order payable to NY State Income Tax ; write your special NYS

identification number and 2014 IT-203-TM on it ..................................................................... 11

.

00

12 Amount overpaid applied to 2015 estimated tax

(if line 10 is greater than line 5, subtract line 5

.

.............................................................................................................................. 12

from line 10)

00

Date

Group agent must complete and sign

Paid preparer must complete

(see instr.)

Preparer’s signature

Preparer’s NYTPRIN

Print name of group agent

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

Title of group agent

Employer identification number

Address

Signature of group agent

NYTPRIN

Date

Daytime phone number

(

)

excl. code

E-mail:

E-mail:

Mail your completed return to:

NEW YORK STATE INCOME TAX, W A HARRIMAN CAMPUS, ALBANY NY 12227-0866.

315001140094

1

1