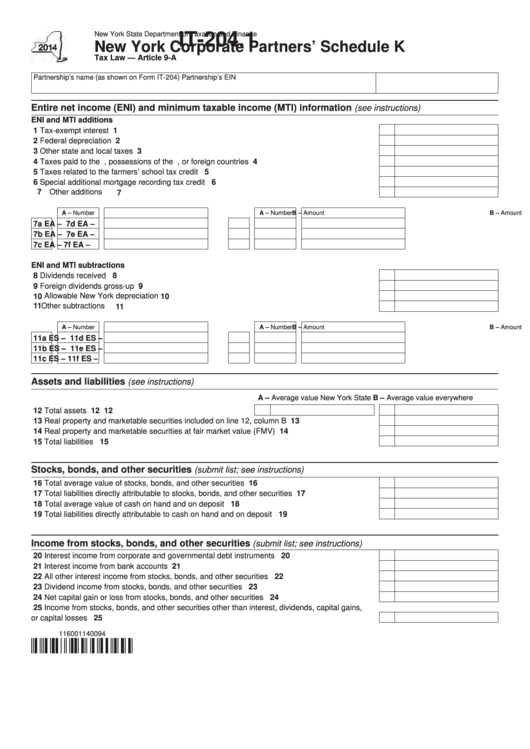

New York State Department of Taxation and Finance

IT-204.1

New York Corporate Partners’ Schedule K

Tax Law — Article 9-A

Partnership’s name (as shown on Form IT-204)

Partnership’s EIN

Entire net income (ENI) and minimum taxable income (MTI) information

(see instructions)

ENI and MTI additions

1 Tax-exempt interest .......................................................................................................................

1

2 Federal depreciation .....................................................................................................................

2

3 Other state and local taxes ...........................................................................................................

3

4 Taxes paid to the U.S., possessions of the U.S., or foreign countries ..........................................

4

5 Taxes related to the farmers’ school tax credit .............................................................................

5

6 Special additional mortgage recording tax credit .........................................................................

6

7 Other additions ..............................................................................................................................

7

A – Number

B – Amount

A – Number

B – Amount

7a

EA –

7d

EA –

7b

EA –

7e

EA –

7c

EA –

7f

EA –

ENI and MTI subtractions

8 Dividends received .......................................................................................................................

8

9 Foreign dividends gross-up ...........................................................................................................

9

10 Allowable New York depreciation ................................................................................................. 10

11 Other subtractions ......................................................................................................................... 11

A – Number

B – Amount

A – Number

B – Amount

11a

ES –

11d

ES –

11b

ES –

11e

ES –

11c

ES –

11f

ES –

Assets and liabilities

(see instructions)

A – Average value New York State

B – Average value everywhere

12 Total assets .......................................................................... 12

12

13 Real property and marketable securities included on line 12, column B ...................................... 13

14 Real property and marketable securities at fair market value (FMV) ............................................ 14

15 Total liabilities ............................................................................................................................... 15

Stocks, bonds, and other securities

(submit list; see instructions)

16 Total average value of stocks, bonds, and other securities .......................................................... 16

17 Total liabilities directly attributable to stocks, bonds, and other securities .................................... 17

18 Total average value of cash on hand and on deposit ................................................................... 18

19 Total liabilities directly attributable to cash on hand and on deposit ............................................ 19

Income from stocks, bonds, and other securities

(submit list; see instructions)

20 Interest income from corporate and governmental debt instruments ........................................... 20

21 Interest income from bank accounts ............................................................................................. 21

22 All other interest income from stocks, bonds, and other securities .............................................. 22

23 Dividend income from stocks, bonds, and other securities .......................................................... 23

24 Net capital gain or loss from stocks, bonds, and other securities ................................................ 24

25 Income from stocks, bonds, and other securities other than interest, dividends, capital gains,

or capital losses ........................................................................................................................ 25

116001140094

1

1 2

2