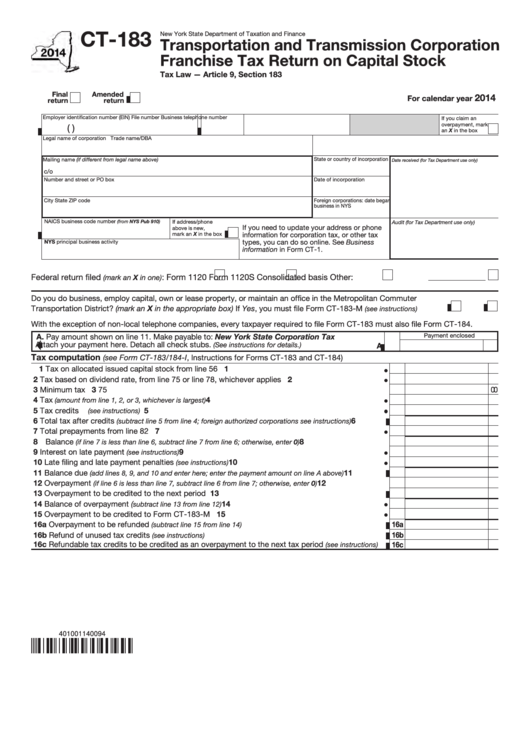

CT-183

New York State Department of Taxation and Finance

Transportation and Transmission Corporation

Franchise Tax Return on Capital Stock

Tax Law — Article 9, Section 183

Final

Amended

2014

For calendar year

return

return

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Mailing name (if different from legal name above)

Date received (for Tax Department use only)

c/o

Number and street or PO box

Date of incorporation

City

State

ZIP code

Foreign corporations: date began

business in NYS

NAICS business code number

(from NYS Pub 910)

If address/phone

Audit (for Tax Department use only)

If you need to update your address or phone

above is new,

mark an X in the box

information for corporation tax, or other tax

types, you can do so online. See Business

NYS principal business activity

information in Form CT-1.

Federal return filed

: Form 1120

Form 1120S

Consolidated basis

Other:

(mark an X in one)

Do you do business, employ capital, own or lease property, or maintain an office in the Metropolitan Commuter

Transportation District? (mark an X in the appropriate box) If Yes, you must file Form CT-183-M

....... Yes

No

(see instructions)

With the exception of non-local telephone companies, every taxpayer required to file Form CT-183 must also file Form CT-184.

A. Pay amount shown on line 11. Make payable to: New York State Corporation Tax

Payment enclosed

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

Tax computation

(see Form CT-183/184-I, Instructions for Forms CT-183 and CT-184)

1 Tax on allocated issued capital stock from line 56 ..........................................................................

1

2 Tax based on dividend rate, from line 75 or line 78, whichever applies ..........................................

2

3 Minimum tax ......................................................................................................................................

3

75 00

4 Tax

..............................................................................

4

(amount from line 1, 2, or 3, whichever is largest)

5 Tax credits

...............................................................................................................

5

(see instructions)

6 Total tax after credits

6

...........

(subtract line 5 from line 4; foreign authorized corporations see instructions)

7 Total prepayments from line 82 ........................................................................................................

7

8 Balance

.......................................

8

(if line 7 is less than line 6, subtract line 7 from line 6; otherwise, enter 0)

9 Interest on late payment

.........................................................................................

9

(see instructions)

10 Late filing and late payment penalties

10

....................................................................

(see instructions)

11 Balance due

................

11

(add lines 8, 9, and 10 and enter here; enter the payment amount on line A above)

12 Overpayment

..............................

12

(if line 6 is less than line 7, subtract line 6 from line 7; otherwise, enter 0)

13 Overpayment to be credited to the next period ...............................................................................

13

14 Balance of overpayment (

........................................................................

14

subtract line 13 from line 12)

15 Overpayment to be credited to Form CT-183-M .............................................................................

15

16a Overpayment to be refunded

16a

.................................................................

(subtract line 15 from line 14)

16b Refund of unused tax credits

16b

..................................................................................

(see instructions)

16c Refundable tax credits to be credited as an overpayment to the next tax period

16c

(see instructions)

401001140094

1

1 2

2 3

3 4

4