Form Ct-185 - Cooperative Agricultural Corporation Franchise Tax Return - 2014

ADVERTISEMENT

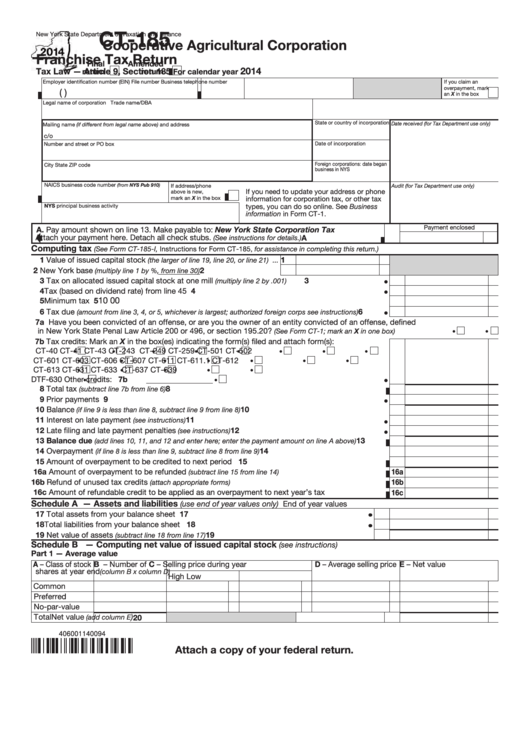

CT-185

New York State Department of Taxation and Finance

Cooperative Agricultural Corporation

Franchise Tax Return

Final

Amended

2014

Tax Law — Article 9, Section 185

return

return

For calendar year

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above) and address

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

(from NYS Pub 910)

If address/phone

Audit (for Tax Department use only)

If you need to update your address or phone

above is new,

mark an X in the box

information for corporation tax, or other tax

NYS principal business activity

types, you can do so online. See Business

information in Form CT-1.

Payment enclosed

A. Pay amount shown on line 13. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

A

(See instructions for details.)

Computing tax

(See Form CT-185-I, Instructions for Form CT-185, for assistance in completing this return.)

1 Value of issued capital stock

1

(the larger of line 19, line 20, or line 21) ...

2 New York base

2

...........

(multiply line 1 by

%, from line 30)

3 Tax on allocated issued capital stock at one mill

3

(multiply line 2 by .001) .................................................

4 Tax (based on dividend rate) from line 45 ........................................................................................

4

10 00

5 Minimum tax ......................................................................................................................................

5

6 Tax due

6

...........

(amount from line 3, 4, or 5, whichever is largest; authorized foreign corps see instructions)

7a Have you been convicted of an offense, or are you the owner of an entity convicted of an offense, defined

in New York State Penal Law Article 200 or 496, or section 195.20?

......... Yes

No

(See Form CT-1; mark an X in one box)

7b Tax credits: Mark an X in the box(es) indicating the form(s) filed and attach form(s):

CT-40

CT-41

CT-43

CT-243

CT-249

CT-259

CT-501

CT-502

CT-601

CT-603

CT-606

CT-607

CT-611

CT-611.1

CT-612

CT-613

CT-631

CT-633

CT-637

CT-639

DTF-630

Other credits:

......................................................................

7b

8 Total tax

...................................................................................................

8

(subtract line 7b from line 6)

9 Prior payments .................................................................................................................................

9

10 Balance

..................................................................

10

(if line 9 is less than line 8, subtract line 9 from line 8)

11 Interest on late payment

.........................................................................................

11

(see instructions)

12 Late filing and late payment penalties

12

....................................................................

(see instructions)

13 Balance due

13

...........

(add lines 10, 11, and 12 and enter here; enter the payment amount on line A above)

14 Overpayment

.........................................................

14

(if line 8 is less than line 9, subtract line 8 from line 9)

15 Amount of overpayment to be credited to next period ....................................................................

15

16a Amount of overpayment to be refunded

16a

...............................................

(subtract line 15 from line 14)

16b Refund of unused tax credits

.....................................................................

16b

(attach appropriate forms)

16c Amount of refundable credit to be applied as an overpayment to next year’s tax ..........................

16c

Schedule A — Assets and liabilities

(use end of year values only)

End of year values

17 Total assets from your balance sheet .......................................................................................

17

18 Total liabilities from your balance sheet ....................................................................................

18

19 Net value of assets

........................................................................... 19

(subtract line 18 from line 17)

Schedule B — Computing net value of issued capital stock

(see instructions)

Part 1 — Average value

A – Class of stock

B – Number of

C – Selling price during year

D – Average selling price

E – Net value

shares at year end

(column B x column D)

High

Low

Common

Preferred

No-par-value

Total

Net value

)

(add column E

20

406001140094

Attach a copy of your federal return.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2