Form Ct-236 - Credit For Taxicabs And Livery Service Vehicles Accessible To Persons With Disabilities - 2014

ADVERTISEMENT

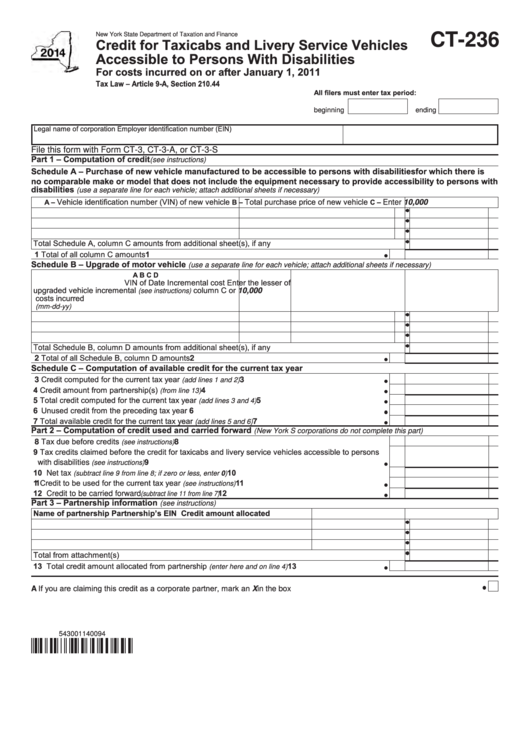

New York State Department of Taxation and Finance

CT-236

Credit for Taxicabs and Livery Service Vehicles

Accessible to Persons With Disabilities

For costs incurred on or after January 1, 2011

Tax Law – Article 9-A, Section 210.44

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form CT-3, CT-3-A, or CT-3-S

Part 1 – Computation of credit

(see instructions)

Schedule A – Purchase of new vehicle manufactured to be accessible to persons with disabilities for which there is

no comparable make or model that does not include the equipment necessary to provide accessibility to persons with

disabilities

(use a separate line for each vehicle; attach additional sheets if necessary)

Vehicle identification number (VIN) of new vehicle

Total purchase price of new vehicle

A –

B –

C –

Enter 10,000

Total Schedule A, column C amounts from additional sheet(s), if any .............................................................

1 Total of all column C amounts ............................................................................................................

1

Schedule B – Upgrade of motor vehicle

(use a separate line for each vehicle; attach additional sheets if necessary)

A

B

C

D

VIN of

Date

Incremental cost

Enter the lesser of

upgraded vehicle

incremental

column C or 10,000

(see instructions)

costs incurred

(mm-dd-yy)

Total Schedule B, column D amounts from additional sheet(s), if any .............................................................

2 Total of all Schedule B, column D amounts ........................................................................................

2

Schedule C – Computation of available credit for the current tax year

3 Credit computed for the current tax year

................................................................

3

(add lines 1 and 2)

4 Credit amount from partnership(s)

4

.................................................................................

(from line 13)

5 Total credit computed for the current tax year

........................................................

5

(add lines 3 and 4)

6 Unused credit from the preceding tax year ........................................................................................

6

7 Total available credit for the current tax year

..........................................................

7

(add lines 5 and 6)

Part 2 – Computation of credit used and carried forward

(New York S corporations do not complete this part)

8 Tax due before credits

................................................................................................

8

(see instructions)

9 Tax credits claimed before the credit for taxicabs and livery service vehicles accessible to persons

9

with disabilities

......................................................................................................

(see instructions)

10 Net tax

.......................................................................... 10

(subtract line 9 from line 8; if zero or less, enter 0)

11 Credit to be used for the current tax year

11

.................................................................

(see instructions)

12 Credit to be carried forward

12

...........................................................................

(subtract line 11 from line 7)

Part 3 – Partnership information

(see instructions)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from attachment(s)...................................................................................................................................

13 Total credit amount allocated from partnership

13

..............................................

(enter here and on line 4)

A If you are claiming this credit as a corporate partner, mark an X in the box .....................................................................................

543001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1