Form Ct-245 - Maintenance Fee And Activities Return For A Foreign Corporation Disclaiming Tax Liability - 2014

ADVERTISEMENT

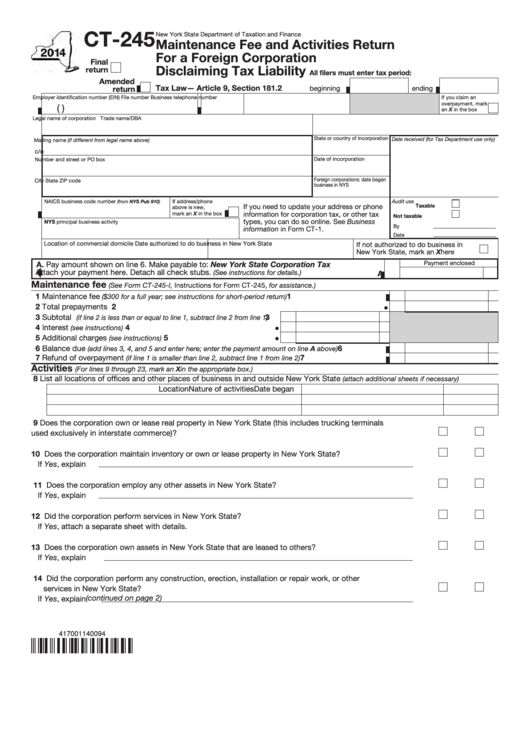

CT-245

New York State Department of Taxation and Finance

Maintenance Fee and Activities Return

For a Foreign Corporation

Final

Disclaiming Tax Liability

return

All filers must enter tax period:

Amended

Tax Law— Article 9, Section 181.2

beginning

ending

return

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

Audit use

(from NYS Pub 910)

Taxable

If you need to update your address or phone

above is new,

mark an X in the box

information for corporation tax, or other tax

Not taxable

types, you can do so online. See Business

NYS principal business activity

By

information in Form CT-1.

Date

Location of commercial domicile

Date authorized to do business in New York State

If not authorized to do business in

New York State, mark an X here ..........

Payment enclosed

A. Pay amount shown on line 6. Make payable to: New York State Corporation Tax

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

Maintenance fee

(See Form CT-245-I, Instructions for Form CT-245, for assistance.)

1 Maintenance fee

............................................

1

($300 for a full year; see instructions for short-period return)

2 Total prepayments ..............................................................................................................................

2

3 Subtotal

....

3

(if line 2 is less than or equal to line 1, subtract line 2 from line 1)

4 Interest

4

....................................................................

(see instructions)

5 Additional charges

..................................................

5

(see instructions)

6 Balance due

....................

6

(add lines 3, 4, and 5 and enter here; enter the payment amount on line A above)

7 Refund of overpayment

......................................

7

(if line 1 is smaller than line 2, subtract line 1 from line 2)

Activities

(For lines 9 through 23, mark an X in the appropriate box.)

8 List all locations of offices and other places of business in and outside New York State

(attach additional sheets if necessary)

Location

Nature of activities

Date began

9 Does the corporation own or lease real property in New York State (this includes trucking terminals

used exclusively in interstate commerce)? ....................................................................................................

Yes

No

10 Does the corporation maintain inventory or own or lease property in New York State? .................................

Yes

No

If Yes, explain

11 Does the corporation employ any other assets in New York State? ................................................................

Yes

No

If Yes, explain

12 Did the corporation perform services in New York State? ...............................................................................

Yes

No

If Yes, attach a separate sheet with details.

13 Does the corporation own assets in New York State that are leased to others? ............................................

Yes

No

If Yes, explain

14 Did the corporation perform any construction, erection, installation or repair work, or other

services in New York State? ..........................................................................................................................

Yes

No

(continued on page 2)

If Yes, explain

417001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2