Form Ct-248 - Claim For Empire State Film Production Credit - 2014

ADVERTISEMENT

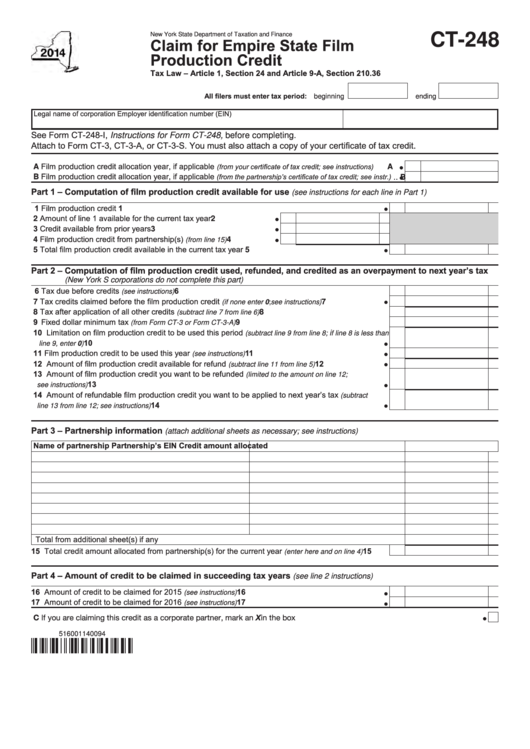

New York State Department of Taxation and Finance

CT-248

Claim for Empire State Film

Production Credit

Tax Law – Article 1, Section 24 and Article 9-A, Section 210.36

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

See Form CT-248-I, Instructions for Form CT-248, before completing.

Attach to Form CT-3, CT-3-A, or CT-3-S. You must also attach a copy of your certificate of tax credit.

A Film production credit allocation year, if applicable

(from your certificate of tax credit; see instructions) .............

A

B Film production credit allocation year, if applicable

(from the partnership’s certificate of tax credit; see instr.)

..

B

Part 1 – Computation of film production credit available for use

(see instructions for each line in Part 1)

1 Film production credit ........................................................................................................................

1

2 Amount of line 1 available for the current tax year ...........................

2

3 Credit available from prior years.......................................................

3

4 Film production credit from partnership(s)

....................

4

(from line 15)

5 Total film production credit available in the current tax year ..............................................................

5

Part 2 – Computation of film production credit used, refunded, and credited as an overpayment to next year’s tax

(New York S corporations do not complete this part)

6 Tax due before credits

6

................................................................................................

(see instructions)

7 Tax credits claimed before the film production credit

.........................

7

(if none enter 0; see instructions)

8 Tax after application of all other credits

........................................................

8

(subtract line 7 from line 6)

9 Fixed dollar minimum tax

9

....................................................................

(from Form CT-3 or Form CT-3-A)

10 Limitation on film production credit to be used this period

i

(subtract line 9 from line 8;

f line 8 is less than

10

....................................................................................................................................

line 9, enter 0)

11 Film production credit to be used this year

11

...............................................................

(see instructions)

12 Amount of film production credit available for refund

12

................................

(subtract line 11 from line 5)

13 Amount of film production credit you want to be refunded

(limited to the amount on line 12;

13

................................................................................................................................

see instructions)

14 Amount of refundable film production credit you want to be applied to next year’s tax

(subtract

14

...................................................................................................

line 13 from line 12; see instructions)

Part 3 – Partnership information

(attach additional sheets as necessary; see instructions)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from additional sheet(s) if any ..................................................................................................................

15 Total credit amount allocated from partnership(s) for the current year

............ 15

(enter here and on line 4)

Part 4 – Amount of credit to be claimed in succeeding tax years

(see line 2 instructions)

16 Amount of credit to be claimed for 2015

16

..................................................................

(see instructions)

17 Amount of credit to be claimed for 2016

17

...................................................................

(see instructions)

C If you are claiming this credit as a corporate partner, mark an X in the box ...................................................................................

516001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1