Form Ct-241 - Claim For Clean Heating Fuel Credit - 2014

ADVERTISEMENT

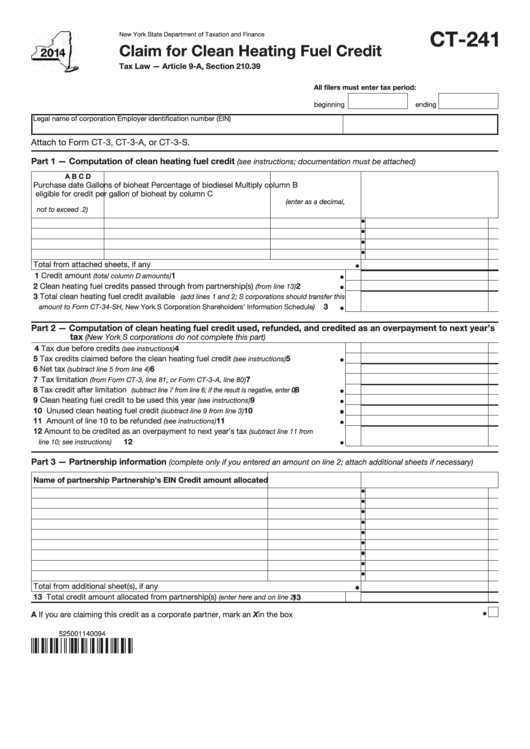

CT-241

New York State Department of Taxation and Finance

Claim for Clean Heating Fuel Credit

Tax Law — Article 9-A, Section 210.39

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

Attach to Form CT-3, CT-3-A, or CT-3-S.

Part 1 — Computation of clean heating fuel credit

(see instructions; documentation must be attached)

A

B

C

D

Purchase date

Gallons of bioheat

Percentage of biodiesel

Multiply column B

eligible for credit

per gallon of bioheat

by column C

(enter as a decimal,

not to exceed .2)

Total from attached sheets, if any ..............................................................................................

1 Credit amount

...........................................................................

1

(total column D amounts)

2 Clean heating fuel credits passed through from partnership(s)

2

.................

(from line 13)

3 Total clean heating fuel credit available

(add lines 1 and 2; S corporations should transfer this

.....

3

amount to Form CT-34-SH, New York S Corporation Shareholders’ Information Schedule)

Part 2 — Computation of clean heating fuel credit used, refunded, and credited as an overpayment to next year’s

tax

(New York S corporations do not complete this part)

4 Tax due before credits

...........................................................................

4

(see instructions)

5 Tax credits claimed before the clean heating fuel credit

5

......................

(see instructions)

6 Net tax

......................................................................................

6

(subtract line 5 from line 4)

7 Tax limitation

...........................................

7

(from Form CT-3, line 81, or Form CT-3-A, line 80)

8 Tax credit after limitation

8

..................

(subtract line 7 from line 6; if the result is negative, enter 0)

9 Clean heating fuel credit to be used this year

......................................

9

(see instructions)

10 Unused clean heating fuel credit

............................................

10

(subtract line 9 from line 3)

11 Amount of line 10 to be refunded

11

.........................................................

(see instructions)

12 Amount to be credited as an overpayment to next year’s tax

(subtract line 11 from

..................................................................................................

12

line 10; see instructions)

Part 3 — Partnership information

(complete only if you entered an amount on line 2; attach additional sheets if necessary)

Name of partnership

Partnership’s EIN

Credit amount allocated

Total from additional sheet(s), if any ...........................................................................................

13 Total credit amount allocated from partnership(s)

...................... 13

(enter here and on line 2)

A If you are claiming this credit as a corporate partner, mark an X in the box ..................................................................................

525001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2