Form Ct-396 - Report Of License Fee Rural Electric Cooperative Corporations

ADVERTISEMENT

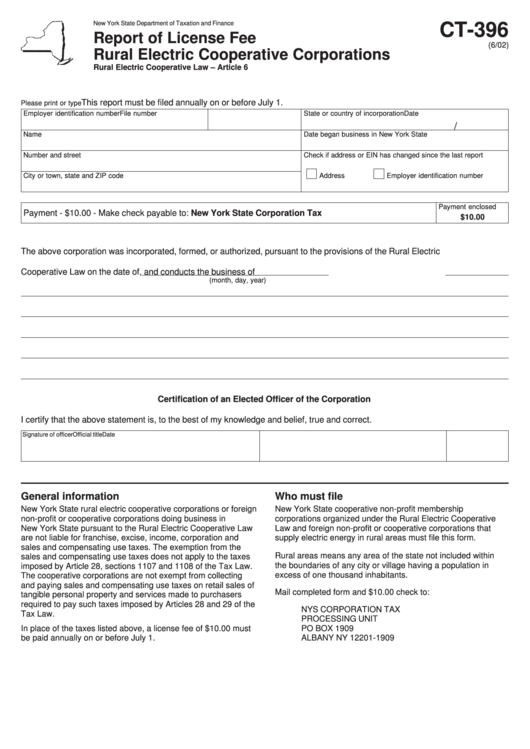

New York State Department of Taxation and Finance

CT-396

Report of License Fee

(6/02)

Rural Electric Cooperative Corporations

Rural Electric Cooperative Law – Article 6

This report must be filed annually on or before July 1.

Please print or type

Employer identification number

File number

State or country of incorporation

Date

/

Name

Date began business in New York State

Number and street

Check if address or EIN has changed since the last report

City or town, state and ZIP code

Address

Employer identification number

Payment enclosed

Payment - $10.00 - Make check payable to: New York State Corporation Tax

$10.00

The above corporation was incorporated, formed, or authorized, pursuant to the provisions of the Rural Electric

Cooperative Law on the date of

, and conducts the business of

(month, day, year)

Certification of an Elected Officer of the Corporation

I certify that the above statement is, to the best of my knowledge and belief, true and correct.

Signature of officer

Official title

Date

General information

Who must file

New York State rural electric cooperative corporations or foreign

New York State cooperative non-profit membership

non-profit or cooperative corporations doing business in

corporations organized under the Rural Electric Cooperative

New York State pursuant to the Rural Electric Cooperative Law

Law and foreign non-profit or cooperative corporations that

are not liable for franchise, excise, income, corporation and

supply electric energy in rural areas must file this form.

sales and compensating use taxes. The exemption from the

Rural areas means any area of the state not included within

sales and compensating use taxes does not apply to the taxes

the boundaries of any city or village having a population in

imposed by Article 28, sections 1107 and 1108 of the Tax Law.

excess of one thousand inhabitants.

The cooperative corporations are not exempt from collecting

and paying sales and compensating use taxes on retail sales of

Mail completed form and $10.00 check to:

tangible personal property and services made to purchasers

required to pay such taxes imposed by Articles 28 and 29 of the

NYS CORPORATION TAX

Tax Law.

PROCESSING UNIT

In place of the taxes listed above, a license fee of $10.00 must

PO BOX 1909

be paid annually on or before July 1.

ALBANY NY 12201-1909

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1