Form Ct-399 - Depreciation Adjustment Schedule - 2014

ADVERTISEMENT

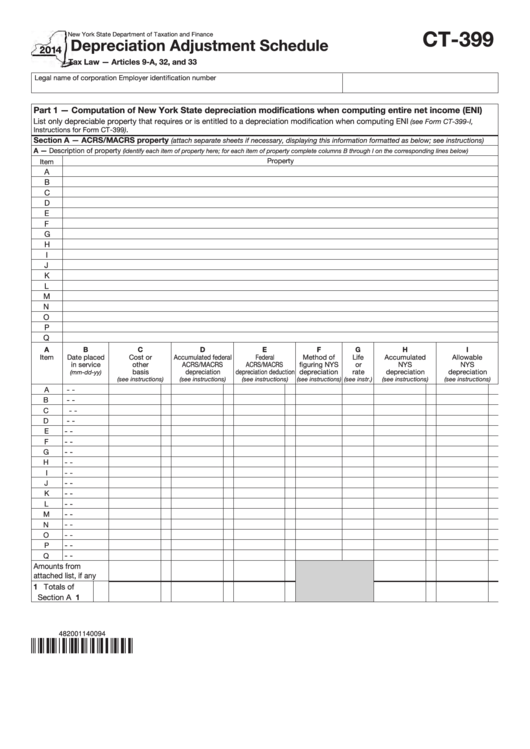

CT-399

New York State Department of Taxation and Finance

Depreciation Adjustment Schedule

Tax Law — Articles 9-A, 32, and 33

Legal name of corporation

Employer identification number

Part 1 — Computation of New York State depreciation modifications when computing entire net income (ENI)

List only depreciable property that requires or is entitled to a depreciation modification when computing ENI

(see Form CT-399-I,

.

Instructions for Form CT-399)

Section A — ACRS/MACRS property

(attach separate sheets if necessary, displaying this information formatted as below; see instructions)

A — Description of property

(identify each item of property here; for each item of property complete columns B through I on the corresponding lines below)

Property

Item

A

B

C

D

E

F

G

H

I

J

K

L

M

N

O

P

Q

A

B

C

D

E

F

G

H

I

Item

Date placed

Cost or

Accumulated federal

Federal

Method of

Life

Accumulated

Allowable

in service

other

ACRS/MACRS

ACRS/MACRS

figuring NYS

or

NYS

NYS

basis

depreciation

depreciation deduction

depreciation

rate

depreciation

depreciation

(mm-dd-yy)

(see instructions)

(see instructions)

(see instructions)

(see instructions)

(see instr.)

(see instructions)

(see instructions)

-

-

A

-

-

B

-

-

C

-

-

D

E

-

-

-

-

F

-

-

G

H

-

-

-

-

I

-

-

J

-

-

K

-

-

L

-

-

M

-

-

N

-

-

O

-

-

P

-

-

Q

Amounts from

attached list, if any ....

1 Totals of

1

Section A

482001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4