Form Ct-603 - Claim For Ez Investment Tax Credit And Ez Employment Incentive Credit - 2014

ADVERTISEMENT

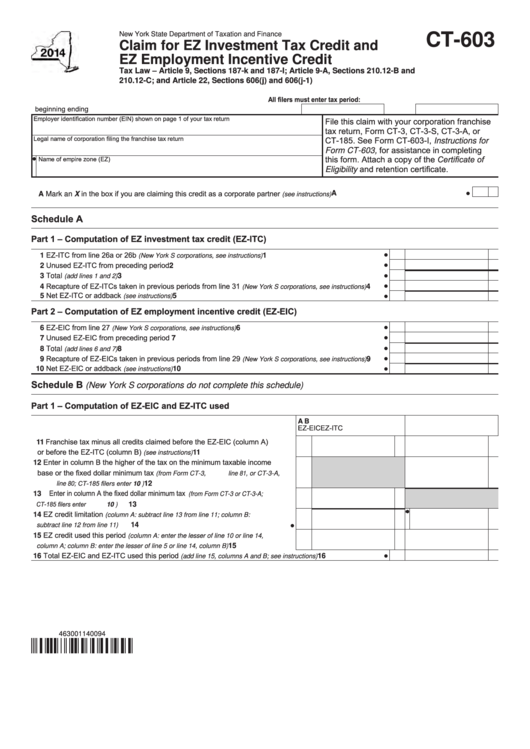

New York State Department of Taxation and Finance

CT-603

Claim for EZ Investment Tax Credit and

EZ Employment Incentive Credit

Tax Law – Article 9, Sections 187-k and 187-l; Article 9-A, Sections 210.12-B and

210.12-C; and Article 22, Sections 606(j) and 606(j-1)

All filers must enter tax period:

beginning

ending

Employer identification number (EIN) shown on page 1 of your tax return

File this claim with your corporation franchise

tax return, Form CT-3, CT-3-S, CT-3-A, or

Legal name of corporation filing the franchise tax return

CT-185. See Form CT-603-I, Instructions for

Form CT-603, for assistance in completing

this form. Attach a copy of the Certificate of

Name of empire zone (EZ)

Eligibility and retention certificate.

A Mark an X in the box if you are claiming this credit as a corporate partner

A

.............................................................

(see instructions)

Schedule A

Part 1 – Computation of EZ investment tax credit (EZ-ITC)

1 EZ-ITC from line 26a or 26b

.......................................................

1

(New York S corporations, see instructions)

2 Unused EZ-ITC from preceding period ......................................................................................................

2

3 Total

...............................................................................................................................

3

(add lines 1 and 2)

4 Recapture of EZ-ITCs taken in previous periods from line 31

....

4

(New York S corporations, see instructions)

5 Net EZ-ITC or addback

...................................................................................................

5

(see instructions)

Part 2 – Computation of EZ employment incentive credit (EZ-EIC)

6 EZ-EIC from line 27

....................................................................

6

(New York S corporations, see instructions)

7 Unused EZ-EIC from preceding period ....................................................................................................

7

8 Total

...............................................................................................................................

8

(add lines 6 and 7)

9 Recapture of EZ-EICs taken in previous periods from line 29

....

9

(New York S corporations, see instructions)

10 Net EZ-EIC or addback

...................................................................................................

10

(see instructions)

Schedule B

(New York S corporations do not complete this schedule)

Part 1 – Computation of EZ-EIC and EZ-ITC used

A

B

EZ-EIC

EZ-ITC

11 Franchise tax minus all credits claimed before the EZ-EIC (column A)

or before the EZ-ITC (column B)

.....................................

11

(see instructions)

12 Enter in column B the higher of the tax on the minimum taxable income

base or the fixed dollar minimum tax

(from Form CT-3, line 81, or CT-3-A,

line 80; CT-185 filers enter 10 )

.......................................................................

12

13 Enter in column A the fixed dollar minimum tax

(from Form CT-3 or CT-3-A;

CT-185 filers enter 10 )

..........................................................................................

13

14 EZ credit limitation

(column A: subtract line 13 from line 11; column B:

14

subtract line 12 from line 11)

............................................................................

15 EZ credit used this period

(column A: enter the lesser of line 10 or line 14,

.....................

15

column A; column B: enter the lesser of line 5 or line 14, column B)

16 Total EZ-EIC and EZ-ITC used this period

...........................

16

(add line 15, columns A and B; see instructions)

463001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3