Form Ct-607 - Claim For Excelsior Jobs Program Tax Credit - 2014

ADVERTISEMENT

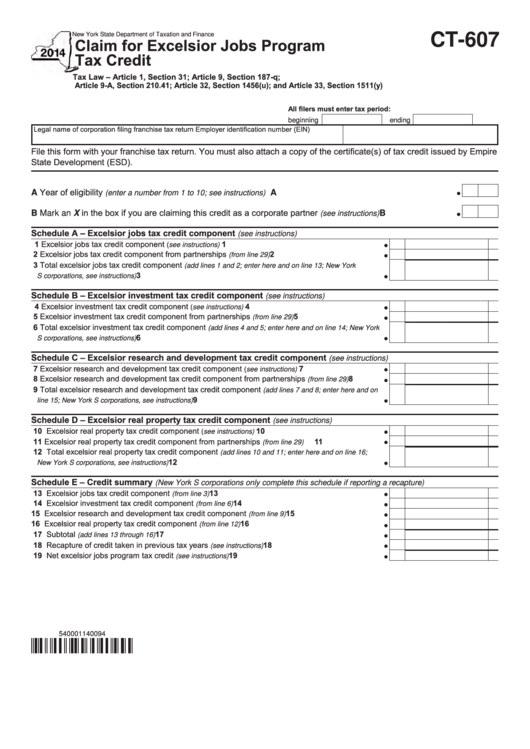

New York State Department of Taxation and Finance

CT-607

Claim for Excelsior Jobs Program

Tax Credit

Tax Law – Article 1, Section 31; Article 9, Section 187-q;

Article 9-A, Section 210.41; Article 32, Section 1456(u); and Article 33, Section 1511(y)

All filers must enter tax period:

beginning

ending

Legal name of corporation filing franchise tax return

Employer identification number (EIN)

File this form with your franchise tax return. You must also attach a copy of the certificate(s) of tax credit issued by Empire

State Development (ESD).

A Year of eligibility

..............................................................................

A

(enter a number from 1 to 10; see instructions)

B Mark an X in the box if you are claiming this credit as a corporate partner

..............................

B

(see instructions)

Schedule A – Excelsior jobs tax credit component

(see instructions)

1 Excelsior jobs tax credit component

.........................................................................

1

(see instructions)

2 Excelsior jobs tax credit component from partnerships

..................................................

2

(from line 29)

3 Total excelsior jobs tax credit component

(add lines 1 and 2; enter here and on line 13; New York

3

...........................................................................................................

S corporations, see instructions)

Schedule B – Excelsior investment tax credit component

(see instructions)

4 Excelsior investment tax credit component

..............................................................

4

(see instructions)

5 Excelsior investment tax credit component from partnerships

.......................................

5

(from line 29)

6 Total excelsior investment tax credit component

(add lines 4 and 5; enter here and on line 14; New York

...........................................................................................................

6

S corporations, see instructions)

Schedule C – Excelsior research and development tax credit component

(see instructions)

7 Excelsior research and development tax credit component

.....................................

(see instructions)

7

8 Excelsior research and development tax credit component from partnerships

..............

8

(from line 29)

9 Total excelsior research and development tax credit component

(add lines 7 and 8; enter here and on

9

.................................................................................

line 15; New York S corporations, see instructions)

Schedule D – Excelsior real property tax credit component

(see instructions)

10 Excelsior real property tax credit component

...........................................................

10

(see instructions)

11 Excelsior real property tax credit component from partnerships

....................................

11

(from line 29)

12 Total excelsior real property tax credit component

(add lines 10 and 11; enter here and on line 16;

12

............................................................................................

New York S corporations, see instructions)

Schedule E – Credit summary

(New York S corporations only complete this schedule if reporting a recapture)

13 Excelsior jobs tax credit component

.................................................................................

13

(from line 3)

14 Excelsior investment tax credit component

......................................................................

14

(from line 6)

15 Excelsior research and development tax credit component

.............................................

15

(from line 9)

16 Excelsior real property tax credit component

.................................................................

16

(from line 12)

17 Subtotal

..........................................................................................................

17

(add lines 13 through 16)

18 Recapture of credit taken in previous tax years

18

........................................................

(see instructions)

19 Net excelsior jobs program tax credit

19

........................................................................

(see instructions)

540001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2