Form Ct-636 - Beer Production Credit - 2014

ADVERTISEMENT

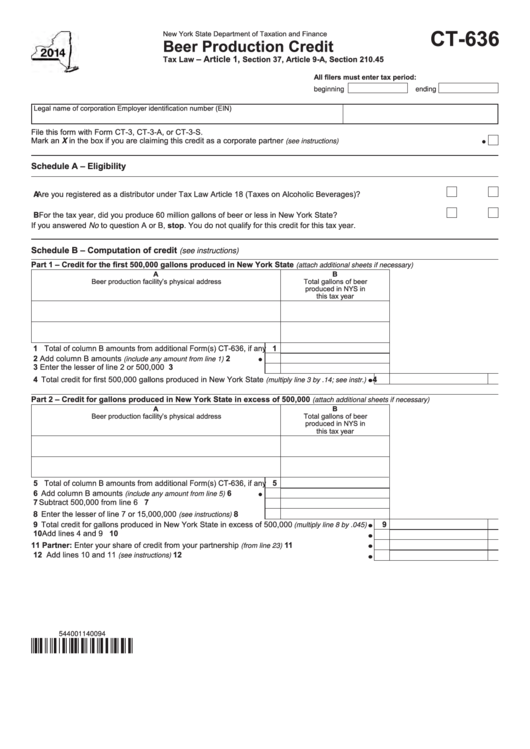

CT-636

New York State Department of Taxation and Finance

Beer Production Credit

– Article 1,

Tax Law

Section 37, Article 9-A, Section 210.45

All filers must enter tax period:

beginning

ending

Legal name of corporation

Employer identification number (EIN)

File this form with Form CT-3, CT-3-A, or CT-3-S.

Mark an X in the box if you are claiming this credit as a corporate partner

(see instructions) ..........................................................................

Schedule A – Eligibility

A Are you registered as a distributor under Tax Law Article 18 (Taxes on Alcoholic Beverages)? .......................... Yes

No

B For the tax year, did you produce 60 million gallons of beer or less in New York State? ..................................... Yes

No

If you answered No to question A or B, stop. You do not qualify for this credit for this tax year.

Schedule B – Computation of credit

(see instructions)

Part 1 – Credit for the first 500,000 gallons produced in New York State

(attach additional sheets if necessary)

A

B

Beer production facility’s physical address

Total gallons of beer

produced in NYS in

this tax year

1 Total of column B amounts from additional Form(s) CT-636, if any

1

2 Add column B amounts

.............

2

(include any amount from line 1)

3 Enter the lesser of line 2 or 500,000 ..........................................

3

4 Total credit for first 500,000 gallons produced in New York State

4

(multiply line 3 by .14; see instr.)

Part 2 – Credit for gallons produced in New York State in excess of 500,000

(attach additional sheets if necessary)

A

B

Beer production facility’s physical address

Total gallons of beer

produced in NYS in

this tax year

5 Total of column B amounts from additional Form(s) CT-636, if any

5

6 Add column B amounts

.............

6

(include any amount from line 5)

7 Subtract 500,000 from line 6 .....................................................

7

8 Enter the lesser of line 7 or 15,000,000

...........

8

(see instructions)

9 Total credit for gallons produced in New York State in excess of 500,000

9

(multiply line 8 by .045)

10 Add lines 4 and 9 .......................................................................................................................

10

11 Partner: Enter your share of credit from your partnership

.....................................

11

(from line 23)

12 Add lines 10 and 11

..........................................................................................

12

(see instructions)

544001140094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2