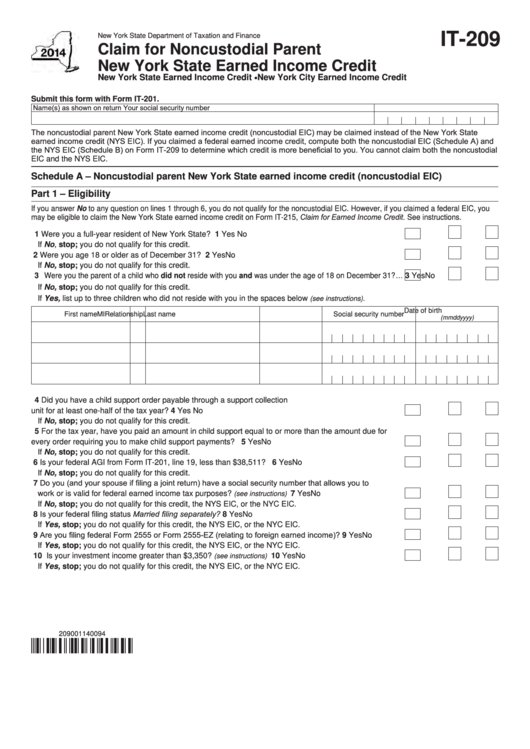

IT-209

New York State Department of Taxation and Finance

Claim for Noncustodial Parent

New York State Earned Income Credit

New York State Earned Income Credit • New York City Earned Income Credit

Submit this form with Form IT-201.

Name(s) as shown on return

Your social security number

The noncustodial parent New York State earned income credit (noncustodial EIC) may be claimed instead of the New York State

earned income credit (NYS EIC). If you claimed a federal earned income credit, compute both the noncustodial EIC (Schedule A) and

the NYS EIC (Schedule B) on Form IT-209 to determine which credit is more beneficial to you. You cannot claim both the noncustodial

EIC and the NYS EIC.

Schedule A – Noncustodial parent New York State earned income credit (noncustodial EIC)

Part 1 – Eligibility

If you answer No to any question on lines 1 through 6, you do not qualify for the noncustodial EIC. However, if you claimed a federal EIC, you

may be eligible to claim the New York State earned income credit on Form IT-215, Claim for Earned Income Credit. See instructions.

1 Were you a full-year resident of New York State? .......................................................................................

1

Yes

No

If No, stop; you do not qualify for this credit.

2 Were you age 18 or older as of December 31? ...........................................................................................

2

Yes

No

If No, stop; you do not qualify for this credit.

3 Were you the parent of a child who did not reside with you and was under the age of 18 on December 31? ...

3

Yes

No

If No, stop; you do not qualify for this credit.

If Yes, list up to three children who did not reside with you in the spaces below

.

(see instructions)

Date of birth

First name

MI

Last name

Relationship

Social security number

(mmddyyyy)

4 Did you have a child support order payable through a support collection

unit for at least one-half of the tax year?..................................................................................................

4

Yes

No

If No, stop; you do not qualify for this credit.

5 For the tax year, have you paid an amount in child support equal to or more than the amount due for

every order requiring you to make child support payments? ...................................................................

5

Yes

No

If No, stop; you do not qualify for this credit.

6 Is your federal AGI from Form IT-201, line 19, less than $38,511? .............................................................

6

Yes

No

If No, stop; you do not qualify for this credit.

7 Do you (and your spouse if filing a joint return) have a social security number that allows you to

work or is valid for federal earned income tax purposes?

.............................................

7

Yes

No

(see instructions)

If No, stop; you do not qualify for this credit, the NYS EIC, or the NYC EIC.

8 Is your federal filing status Married filing separately?..................................................................................

8

Yes

No

If Yes, stop; you do not qualify for this credit, the NYS EIC, or the NYC EIC.

9 Are you filing federal Form 2555 or Form 2555-EZ (relating to foreign earned income)? ...........................

9

Yes

No

If Yes, stop; you do not qualify for this credit, the NYS EIC, or the NYC EIC.

10 Is your investment income greater than $3,350?

.............................................................. 10

Yes

No

(see instructions)

If Yes, stop; you do not qualify for this credit, the NYS EIC, or the NYC EIC.

209001140094

1

1 2

2 3

3 4

4