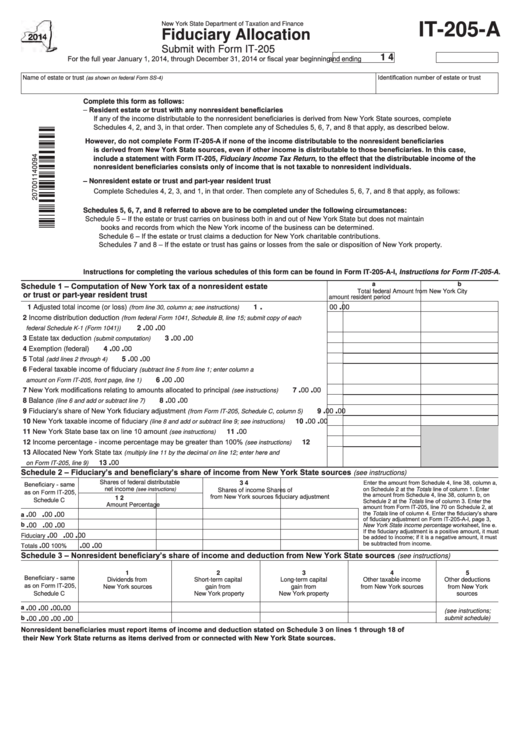

New York State Department of Taxation and Finance

IT-205-A

Fiduciary Allocation

Submit with Form IT-205

1 4

For the full year January 1, 2014, through December 31, 2014 or fiscal year beginning

and ending

Name of estate or trust

Identification number of estate or trust

(as shown on federal Form SS-4)

Complete this form as follows:

– Resident estate or trust with any nonresident beneficiaries

If any of the income distributable to the nonresident beneficiaries is derived from New York State sources, complete

Schedules 4, 2, and 3, in that order. Then complete any of Schedules 5, 6, 7, and 8 that apply, as described below.

However, do not complete Form IT-205-A if none of the income distributable to the nonresident beneficiaries

is derived from New York State sources, even if other income is distributable to those beneficiaries. In this case,

include a statement with Form IT-205, Fiduciary Income Tax Return, to the effect that the distributable income of the

nonresident beneficiaries consists only of income that is not taxable to nonresident individuals.

– Nonresident estate or trust and part-year resident trust

Complete Schedules 4, 2, 3, and 1, in that order. Then complete any of Schedules 5, 6, 7, and 8 that apply, as follows:

Schedules 5, 6, 7, and 8 referred to above are to be completed under the following circumstances:

Schedule 5 – If the estate or trust carries on business both in and out of New York State but does not maintain

books and records from which the New York income of the business can be determined.

Schedule 6 – If the estate or trust claims a deduction for New York charitable contributions.

Schedules 7 and 8 – If the estate or trust has gains or losses from the sale or disposition of New York property.

Instructions for completing the various schedules of this form can be found in Form IT-205-A-I, Instructions for Form IT‑205‑A.

Schedule 1 – Computation of New York tax of a nonresident estate

a

b

Total federal

Amount from New York City

or trust or part-year resident trust

amount

resident period

.

.

1 Adjusted total income (or loss)

..........................................

00

00

1

(from line 30, column a; see instructions)

2 Income distribution deduction

(from federal Form 1041, Schedule B, line 15; submit copy of each

.

.

. ...............................................................................................

00

00

2

federal Schedule K-1 (Form 1041))

.

.

3 Estate tax deduction

.....................................................................................

00

00

3

(submit computation)

.

.

4 Exemption (federal) .....................................................................................................................

00

00

4

.

.

5 Total

............................................................................................................

00

00

5

(add lines 2 through 4)

6 Federal taxable income of fiduciary

(subtract line 5 from line 1; enter column a

.

.

......................................................................................

00

00

6

amount on Form IT-205, front page, line 1)

.

.

7 New York modifications relating to amounts allocated to principal

. ....................

00

00

7

(see instructions)

.

.

8 Balance

........................................................................................

00

00

8

(line 6 and add or subtract line 7)

.

.

9 Fiduciary’s share of New York fiduciary adjustment

........

00

00

9

(from Form IT-205, Schedule C, column 5)

.

.

10 New York taxable income of fiduciary

...................

00

00

10

(line 8 and add or subtract line 9; see instructions)

.

11 New York State base tax on line 10 amount

. ......................................................

00

11

(see instructions)

12 Income percentage - income percentage may be greater than 100%

...............

12

(see instructions)

13 Allocated New York State tax

(multiply line 11 by the decimal on line 12; enter here and

.

. .................................................................................................................

00

13

on Form IT-205, line 9)

Schedule 2 – Fiduciary’s and beneficiary’s share of income from New York State sources

(see instructions)

Shares of federal distributable

Enter the amount from Schedule 4, line 38, column a,

Beneficiary - same

3

4

net income

on Schedule 2 at the Totals line of column 1. Enter

Shares of income

Shares of

(see instructions)

as on Form IT-205,

the amount from Schedule 4, line 38, column b, on

from New York sources

fiduciary adjustment

1

2

Schedule C

Schedule 2 at the Totals line of column 3. Enter the

Amount

Percentage

amount from Form IT-205, line 70 on Schedule 2, at

.

.

.

the Totals line of column 4. Enter the fiduciary’s share

00

00

00

a

of fiduciary adjustment on Form IT-205-A-I, page 3,

.

.

.

00

00

00

New York State income percentage worksheet, line e.

b

If the fiduciary adjustment is a positive amount, it must

.

.

.

00

00

00

Fiduciary

be added to income; if it is a negative amount, it must

.

.

.

be subtracted from income.

00

00

00

Totals

100%

Schedule 3 – Nonresident beneficiary’s share of income and deduction from New York State sources

(see instructions)

1

2

3

4

5

Beneficiary - same

Dividends from

Short-term capital

Long-term capital

Other taxable income

Other deductions

as on Form IT-205,

New York sources

gain from

gain from

from New York sources

from New York

Schedule C

New York property

New York property

sources

.

.

.

.

00

00

00

00

a

(see instructions;

.

.

.

.

00

00

00

00

b

submit schedule)

Nonresident beneficiaries must report items of income and deduction stated on Schedule 3 on lines 1 through 18 of

their New York State returns as items derived from or connected with New York State sources.

1

1 2

2 3

3 4

4