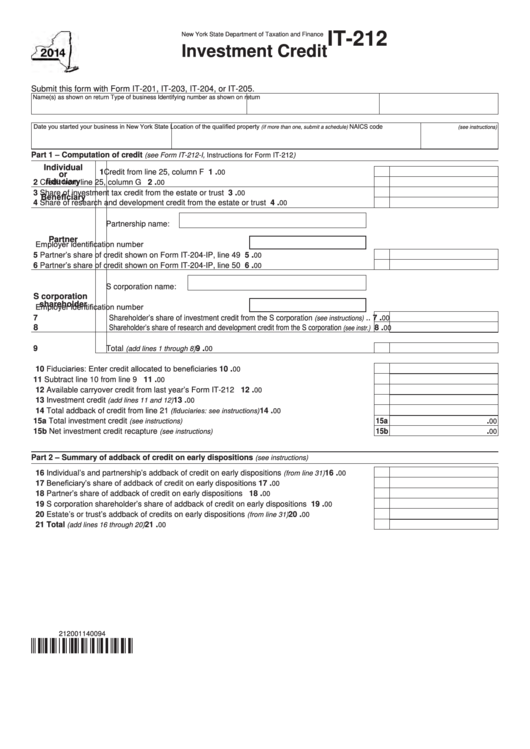

IT-212

New York State Department of Taxation and Finance

Investment Credit

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Type of business

Identifying number as shown on return

Date you started your business in New York State

Location of the qualified property

NAICS code

(if more than one, submit a schedule)

(see instructions)

Part 1 – Computation of credit

(see Form IT-212-I, Instructions for Form IT-212)

Individual

.

1 Credit from line 25, column F ..........................................................................

1

00

or

fiduciary

.

2 Credit from line 25, column G .........................................................................

2

00

.

3 Share of investment tax credit from the estate or trust ....................................

3

00

Beneficiary

.

4 Share of research and development credit from the estate or trust ................

4

00

Partnership name:

Partner

Employer identification number .............

.

5 Partner’s share of credit shown on Form IT-204-IP, line 49 ............................

5

00

.

6 Partner’s share of credit shown on Form IT-204-IP, line 50 ............................

6

00

S corporation name:

S corporation

shareholder

Employer identification number ............

.

7 Shareholder’s share of investment credit from the S corporation

..

7

(see instructions)

00

.

8

Shareholder’s share of research and development credit from the S corporation

8

(see instr.)

00

.

9 Total

................................................................................

9

(add lines 1 through 8)

00

10 Fiduciaries: Enter credit allocated to beneficiaries ..................................................................... 10

.

00

.

11 Subtract line 10 from line 9 ........................................................................................................

11

00

.

12 Available carryover credit from last year’s Form IT-212 ............................................................. 12

00

.

13 Investment credit

.......................................................................................... 13

(add lines 11 and 12)

00

(fiduciaries: see instructions)

.

14 Total addback of credit from line 21

.................................................. 14

00

.

15a Total investment credit

...................................................................................... 15a

(see instructions)

00

.

15b Net investment credit recapture

........................................................................ 15b

(see instructions)

00

Part 2 – Summary of addback of credit on early dispositions

(see instructions)

.

16 Individual’s and partnership’s addback of credit on early dispositions

.................... 16

(from line 31)

00

17 Beneficiary’s share of addback of credit on early dispositions ................................................... 17

.

00

.

18 Partner’s share of addback of credit on early dispositions ......................................................... 18

00

.

19 S corporation shareholder’s share of addback of credit on early dispositions ............................ 19

00

.

20 Estate’s or trust’s addback of credits on early dispositions

.................................... 20

(from line 31)

00

.

21 Total

....................................................................................................... 21

(add lines 16 through 20)

00

212001140094

1

1 2

2