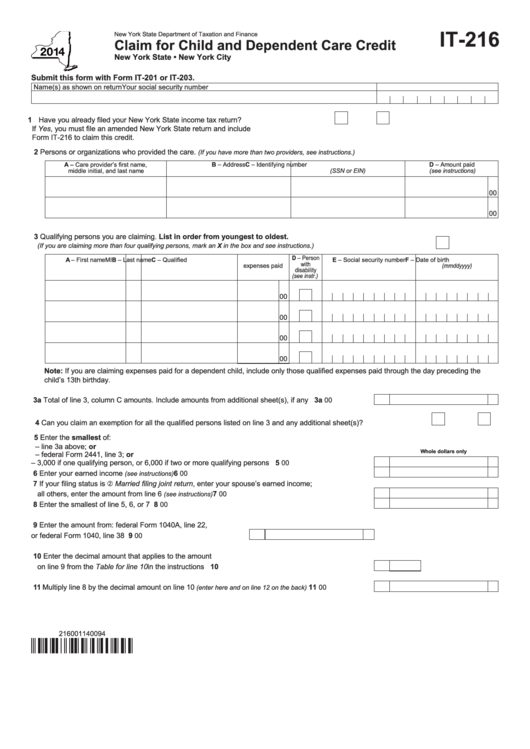

IT-216

New York State Department of Taxation and Finance

Claim for Child and Dependent Care Credit

New York State • New York City

Submit this form with Form IT-201 or IT-203.

Name(s) as shown on return

Your social security number

1 Have you already filed your New York State income tax return? ................................ Yes

No

If Yes, you must file an amended New York State return and include

Form IT-216 to claim this credit.

2 Persons or organizations who provided the care.

(If you have more than two providers, see instructions.)

A – Care provider’s first name,

B – Address

C – Identifying number

D – Amount paid

middle initial, and last name

(SSN or EIN)

(see instructions)

00

00

3 Qualifying persons you are claiming. List in order from youngest to oldest.

...............................................

(If you are claiming more than four qualifying persons, mark an X in the box and see instructions.)

D – Person

A – First name

MI

B – Last name

C – Qualified

E – Social security number

F – Date of birth

with

expenses paid

(mmddyyyy)

disability

(see instr.)

00

00

00

00

Note: If you are claiming expenses paid for a dependent child, include only those qualified expenses paid through the day preceding the

child’s 13th birthday.

3a Total of line 3, column C amounts. Include amounts from additional sheet(s), if any ............................ 3a

00

4 Can you claim an exemption for all the qualified persons listed on line 3 and any additional sheet(s)?...................... Yes

No

5 Enter the smallest of:

– line 3a above; or

Whole dollars only

– federal Form 2441, line 3; or

5

– 3,000 if one qualifying person, or 6,000 if two or more qualifying persons ......................................

00

6 Enter your earned income

............................................................................................

6

00

(see instructions)

7 If your filing status is Married filing joint return, enter your spouse’s earned income;

all others, enter the amount from line 6

....................................................................

7

00

(see instructions)

8 Enter the smallest of line 5, 6, or 7 .........................................................................................................

8

00

9 Enter the amount from: federal Form 1040A, line 22,

or federal Form 1040, line 38 ................................................

9

00

10 Enter the decimal amount that applies to the amount

on line 9 from the Table for line 10 in the instructions ....................................................................... 10

11 Multiply line 8 by the decimal amount on line 10

...........................

11

00

(enter here and on line 12 on the back)

216001140094

1

1 2

2