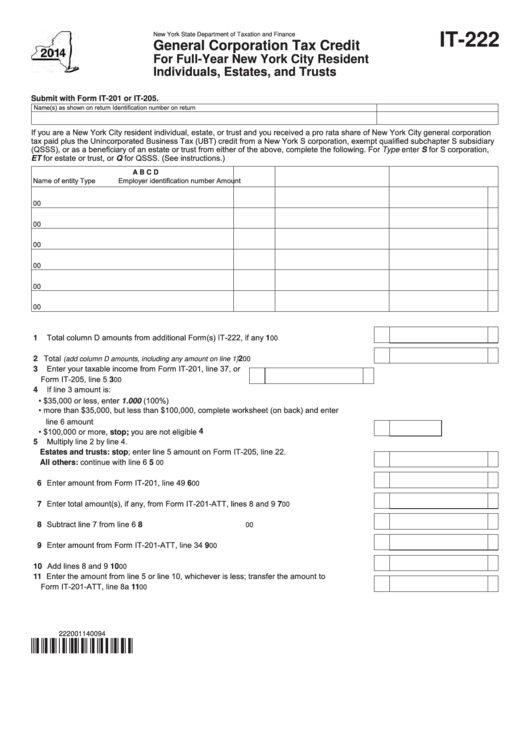

New York State Department of Taxation and Finance

IT-222

General Corporation Tax Credit

For Full-Year New York City Resident

Individuals, Estates, and Trusts

Submit with Form IT-201 or IT-205.

Name(s) as shown on return

Identification number on return

If you are a New York City resident individual, estate, or trust and you received a pro rata share of New York City general corporation

tax paid plus the Unincorporated Business Tax (UBT) credit from a New York S corporation, exempt qualified subchapter S subsidiary

(QSSS), or as a beneficiary of an estate or trust from either of the above, complete the following. For Type enter S for S corporation,

ET for estate or trust, or Q for QSSS. (See instructions.)

A

B

C

D

Name of entity

Type

Employer identification number

Amount

00

00

00

00

00

00

1 Total column D amounts from additional Form(s) IT-222, if any ..................................................

1

00

2 Total

............................................................

2

(add column D amounts, including any amount on line 1)

00

3 Enter your taxable income from Form IT-201, line 37, or

Form IT-205, line 5 .........................................................

3

00

4 If line 3 amount is:

• $35,000 or less, enter 1.000 (100%)

• more than $35,000, but less than $100,000, complete worksheet (on back) and enter

line 6 amount

• $100,000 or more, stop; you are not eligible ............................................................................

4

5 Multiply line 2 by line 4.

Estates and trusts: stop; enter line 5 amount on Form IT-205, line 22.

All others: continue with line 6 ...............................................................................................

5

00

6 Enter amount from Form IT-201, line 49 .....................................................................................

6

00

7 Enter total amount(s), if any, from Form IT-201-ATT, lines 8 and 9 .............................................

7

00

8 Subtract line 7 from line 6 ............................................................................................................

8

00

9 Enter amount from Form IT-201-ATT, line 34 ..............................................................................

9

00

10 Add lines 8 and 9 ......................................................................................................................... 10

00

11 Enter the amount from line 5 or line 10, whichever is less; transfer the amount to

Form IT-201-ATT, line 8a ......................................................................................................... 11

00

222001140094

1

1 2

2