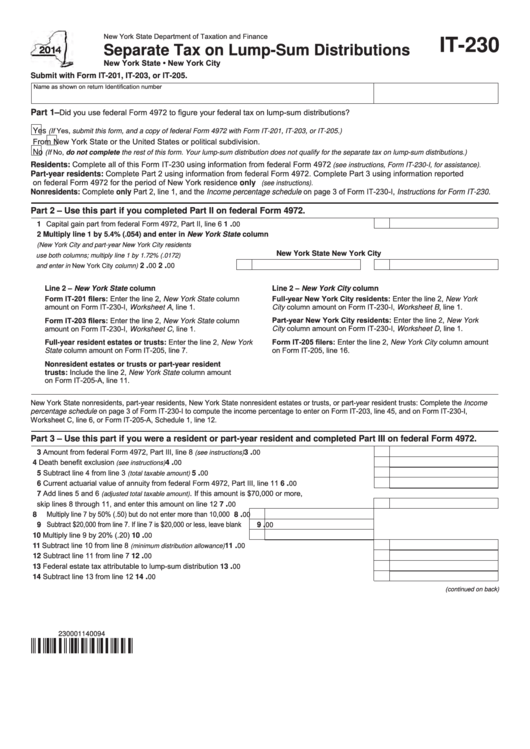

New York State Department of Taxation and Finance

IT-230

Separate Tax on Lump-Sum Distributions

New York State • New York City

Submit with Form IT-201, IT-203, or IT-205.

Name as shown on return

Identification number

Did you use federal Form 4972 to figure your federal tax on lump-sum distributions?

Part 1 –

(If Yes, submit this form, and a copy of federal Form 4972 with Form IT-201, IT-203, or IT-205.)

Yes

From New York State or the United States or political subdivision.

(If No, do not complete the rest of this form. Your lump-sum distribution does not qualify for the separate tax on lump-sum distributions.)

No

Residents: Complete all of this Form IT-230 using information from federal Form 4972

(see instructions, Form IT-230-I, for assistance)

.

Part-year residents: Complete Part 2 using information from federal Form 4972. Complete Part 3 using information reported

on federal Form 4972 for the period of New York residence only

(see instructions).

Nonresidents: Complete only Part 2, line 1, and the Income percentage schedule on page 3 of Form IT-230-I, Instructions for Form IT-230.

Part 2 – Use this part if you completed Part II on federal Form 4972.

1 Capital gain part from federal Form 4972, Part II, line 6 ......................................................................

.

1

00

2 Multiply line 1 by 5.4% (.054) and enter in New York State column

(New York City and part-year New York City residents

New York City

New York State

use both columns; multiply line 1 by 1.72% (.0172)

.

.

.....................................

2

00

2

00

and enter in New York City column)

Line 2 – New York State column

Line 2 – New York City column

Full-year New York City residents: Enter the line 2, New York

Form IT-201 filers: Enter the line 2, New York State column

amount on Form IT-230-I, Worksheet A, line 1.

City column amount on Form IT-230-I, Worksheet B, line 1.

Part-year New York City residents: Enter the line 2, New York

Form IT-203 filers: Enter the line 2, New York State column

amount on Form IT-230-I, Worksheet C, line 1.

City column amount on Form IT-230-I, Worksheet D, line 1.

Form IT-205 filers: Enter the line 2, New York City column amount

Full-year resident estates or trusts: Enter the line 2, New York

State column amount on Form IT-205, line 7.

on Form IT-205, line 16.

Nonresident estates or trusts or part-year resident

trusts: Include the line 2, New York State column amount

on Form IT-205-A, line 11.

New York State nonresidents, part-year residents, New York State nonresident estates or trusts, or part-year resident trusts: Complete the Income

percentage schedule on page 3 of Form IT-230-I to compute the income percentage to enter on Form IT-203, line 45, and on Form IT-230-I,

Worksheet C, line 6, or Form IT-205-A, Schedule 1, line 12.

Part 3 – Use this part if you were a resident or part-year resident and completed Part III on federal Form 4972.

3 Amount from federal Form 4972, Part III, line 8

.

..........................................................

3

(see instructions)

00

4 Death benefit exclusion

.

..............................................................................................

4

(see instructions)

00

5 Subtract line 4 from line 3

.

....................................................................................

5

00

(total taxable amount)

6 Current actuarial value of annuity from federal Form 4972, Part III, line 11 .........................................

.

6

00

7 Add lines 5 and 6

If this amount is $70,000 or more,

.

(adjusted total taxable amount)

skip lines 8 through 11, and enter this amount on line 12 ................................................................

.

7

00

8 Multiply line 7 by 50% (.50) but do not enter more than 10,000 .....

.

8

00

9 Subtract $20,000 from line 7. If line 7 is $20,000 or less, leave blank

.

9

00

10 Multiply line 9 by 20% (.20) ..................................................... 10

.

00

11 Subtract line 10 from line 8

.

................................................................... 11

00

(minimum distribution allowance)

12 Subtract line 11 from line 7 .................................................................................................................. 12

.

00

13 Federal estate tax attributable to lump-sum distribution ...................................................................... 13

.

00

14 Subtract line 13 from line 12 ................................................................................................................ 14

.

00

(continued on back)

230001140094

1

1 2

2