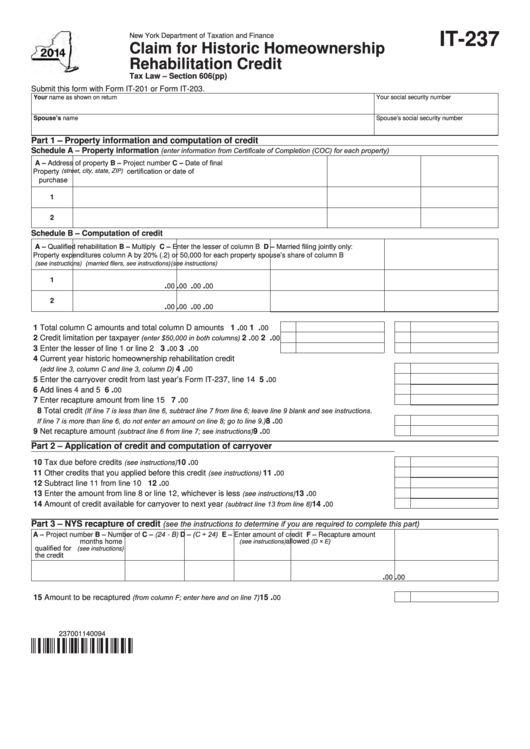

IT-237

New York Department of Taxation and Finance

Claim for Historic Homeownership

Rehabilitation Credit

Tax Law – Section 606(pp)

Submit this form with Form IT-201 or Form IT-203.

Your name as shown on return

Your social security number

Spouse’s name

Spouse’s social security number

Part 1 – Property information and computation of credit

(enter information from Certificate of Completion (COC) for each property)

Schedule A – Property information

C – Date of final

A – Address of property

B – Project number

certification or date of

Property

(street, city, state, ZIP)

purchase

1

2

Schedule B – Computation of credit

A – Qualified rehabilitation

D – Married filing jointly only:

B – Multiply

C – Enter the lesser of column B

Property

expenditures

column A by 20% (.2)

or 50,000 for each property

spouse’s share of column B

(married filers, see instructions)

(see instructions)

(see instructions)

1

.

.

.

.

00

00

00

00

2

.

.

.

.

00

00

00

00

.

.

1 Total column C amounts and total column D amounts .....................

1

1

00

00

(enter $50,000 in both columns)

.

.

2 Credit limitation per taxpayer

.............

2

2

00

00

.

.

3 Enter the lesser of line 1 or line 2 .....................................................

3

3

00

00

4 Current year historic homeownership rehabilitation credit

(add line 3, column C and line 3, column D)

.

.............................................................................................

4

00

.

5 Enter the carryover credit from last year’s Form IT-237, line 14 ..........................................................

5

00

.

6 Add lines 4 and 5 ..................................................................................................................................

6

00

.

7 Enter recapture amount from line 15 ....................................................................................................

7

00

(If line 7 is less than line 6, subtract line 7 from line 6; leave line 9 blank and see instructions.

8 Total credit

If line 7 is more than line 6, do not enter an amount on line 8; go to line 9.)

.

..................................................

8

00

(subtract line 6 from line 7; see instructions)

.

9 Net recapture amount

............................................................

9

00

Part 2 – Application of credit and computation of carryover

.

10 Tax due before credits

................................................................................................. 10

(see instructions)

00

.

11 Other credits that you applied before this credit

......................................................... 11

(see instructions)

00

.

12 Subtract line 11 from line 10 ................................................................................................................. 12

00

.

13 Enter the amount from line 8 or line 12, whichever is less

.......................................... 13

(see instructions)

00

(subtract line 13 from line 8)

.

14 Amount of credit available for carryover to next year

.................................. 14

00

(see the instructions to determine if you are required to complete this part)

Part 3 – NYS recapture of credit

D – (C ÷ 24)

A – Project number

B – Number of

C – (24 - B)

E – Enter amount of credit

F – Recapture amount

(D × E)

months home

allowed

(see instructions)

qualified for

(see instructions)

the credit

.

.

00

00

(from column F; enter here and on line 7)

.

15 Amount to be recaptured

........................................................... 15

00

237001140094

1

1