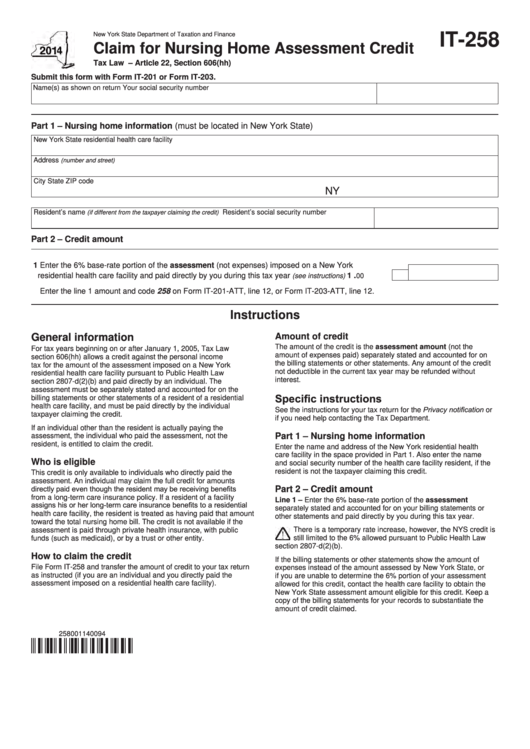

New York State Department of Taxation and Finance

IT-258

Claim for Nursing Home Assessment Credit

Tax Law – Article 22, Section 606(hh)

Submit this form with Form IT-201 or Form IT-203.

Name(s) as shown on return

Your social security number

Part 1 – Nursing home information (must be located in New York State)

New York State residential health care facility

Address

(number and street)

City

State

ZIP code

NY

Resident’s name

Resident’s social security number

(if different from the taxpayer claiming the credit)

Part 2 – Credit amount

1 Enter the 6% base-rate portion of the assessment (not expenses) imposed on a New York

residential health care facility and paid directly by you during this tax year

...........

00

.

1

(see instructions)

Enter the line 1 amount and code 258 on Form IT-201-ATT, line 12, or Form IT-203-ATT, line 12.

Instructions

Amount of credit

General information

The amount of the credit is the assessment amount (not the

For tax years beginning on or after January 1, 2005, Tax Law

amount of expenses paid) separately stated and accounted for on

section 606(hh) allows a credit against the personal income

the billing statements or other statements. Any amount of the credit

tax for the amount of the assessment imposed on a New York

not deductible in the current tax year may be refunded without

residential health care facility pursuant to Public Health Law

interest.

section 2807-d(2)(b) and paid directly by an individual. The

assessment must be separately stated and accounted for on the

Specific instructions

billing statements or other statements of a resident of a residential

health care facility, and must be paid directly by the individual

See the instructions for your tax return for the Privacy notification or

taxpayer claiming the credit.

if you need help contacting the Tax Department.

If an individual other than the resident is actually paying the

assessment, the individual who paid the assessment, not the

Part 1 – Nursing home information

resident, is entitled to claim the credit.

Enter the name and address of the New York residential health

care facility in the space provided in Part 1. Also enter the name

Who is eligible

and social security number of the health care facility resident, if the

resident is not the taxpayer claiming this credit.

This credit is only available to individuals who directly paid the

assessment. An individual may claim the full credit for amounts

directly paid even though the resident may be receiving benefits

Part 2 – Credit amount

from a long-term care insurance policy. If a resident of a facility

Line 1 – Enter the 6% base-rate portion of the assessment

assigns his or her long-term care insurance benefits to a residential

separately stated and accounted for on your billing statements or

health care facility, the resident is treated as having paid that amount

other statements and paid directly by you during this tax year.

toward the total nursing home bill. The credit is not available if the

There is a temporary rate increase, however, the NYS credit is

assessment is paid through private health insurance, with public

still limited to the 6% allowed pursuant to Public Health Law

funds (such as medicaid), or by a trust or other entity.

section 2807-d(2)(b).

How to claim the credit

If the billing statements or other statements show the amount of

File Form IT-258 and transfer the amount of credit to your tax return

expenses instead of the amount assessed by New York State, or

as instructed (if you are an individual and you directly paid the

if you are unable to determine the 6% portion of your assessment

assessment imposed on a residential health care facility).

allowed for this credit, contact the health care facility to obtain the

New York State assessment amount eligible for this credit. Keep a

copy of the billing statements for your records to substantiate the

amount of credit claimed.

258001140094

1

1