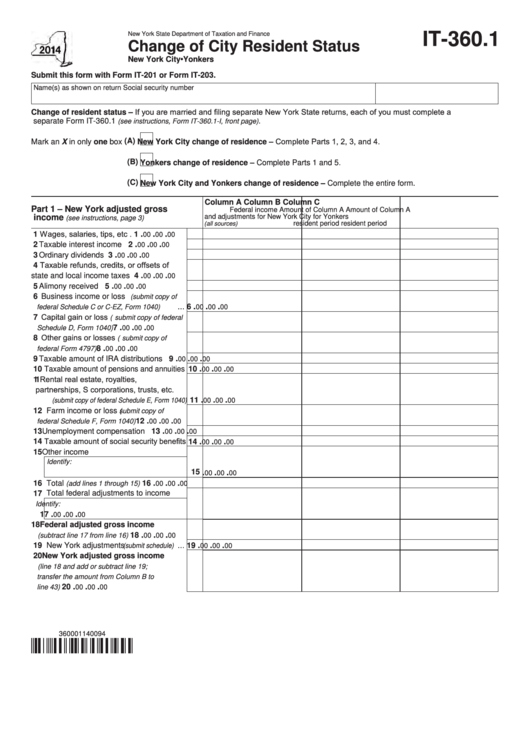

New York State Department of Taxation and Finance

IT-360.1

Change of City Resident Status

New York City • Yonkers

Submit this form with Form IT-201 or Form IT-203.

Name(s) as shown on return

Social security number

Change of resident status – If you are married and filing separate New York State returns, each of you must complete a

separate Form IT-360.1

.

(see instructions, Form IT-360.1-I, front page)

New York City change of residence – Complete Parts 1, 2, 3, and 4.

Mark an X in only one box (A)

(B)

Yonkers change of residence – Complete Parts 1 and 5.

(C)

New York City and Yonkers change of residence – Complete the entire form.

Column A

Column B

Column C

Part 1 – New York adjusted gross

Federal income

Amount of Column A

Amount of Column A

and adjustments

for New York City

for Yonkers

income

(see instructions, page 3)

resident period

resident period

(all sources)

1 Wages, salaries, tips, etc . ......................

.

.

.

1

00

00

00

.

.

.

2 Taxable interest income .........................

2

00

00

00

.

.

.

3 Ordinary dividends .................................

3

00

00

00

4 Taxable refunds, credits, or offsets of

.

.

.

state and local income taxes ..............

4

00

00

00

.

.

.

5 Alimony received ...................................

5

00

00

00

6 Business income or loss

(submit copy of

.

.

.

...

6

federal Schedule C or C-EZ, Form 1040)

00

00

00

7 Capital gain or loss

(submit copy of federal

.

.

.

........................

7

Schedule D, Form 1040)

00

00

00

8 Other gains or losses

(submit copy of

.

.

.

................................

8

federal Form 4797)

00

00

00

.

.

.

9 Taxable amount of IRA distributions ......

9

00

00

00

.

.

.

10 Taxable amount of pensions and annuities 10

00

00

00

11 Rental real estate, royalties,

partnerships, S corporations, trusts, etc.

.

.

.

11

(submit copy of federal Schedule E, Form 1040)

00

00

00

12 Farm income or loss

(submit copy of

.

.

.

............... 12

federal Schedule F, Form 1040)

00

00

00

.

.

.

13 Unemployment compensation ............... 13

00

00

00

14 Taxable amount of social security benefits 14

.

.

.

00

00

00

15 Other income .........................................

Identify:

15

.

.

.

00

00

00

.

.

.

16 Total

.................... 16

(add lines 1 through 15)

00

00

00

17 Total federal adjustments to income

Identify:

.

.

.

17

00

00

00

18 Federal adjusted gross income

.

.

.

.................. 18

(subtract line 17 from line 16)

00

00

00

.

.

.

19 New York adjustments

...

19

(submit schedule)

00

00

00

20 New York adjusted gross income

(line 18 and add or subtract line 19;

transfer the amount from Column B to

.

.

.

................................................. 20

line 43)

00

00

00

360001140094

1

1 2

2 3

3