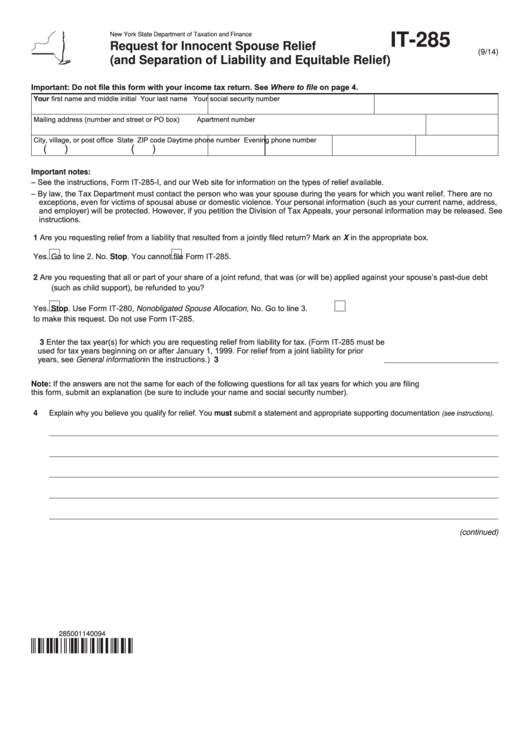

New York State Department of Taxation and Finance

IT-285

Request for Innocent Spouse Relief

(9/14)

(and Separation of Liability and Equitable Relief)

Important: Do not file this form with your income tax return. See Where to file on page 4.

Your first name and middle initial

Your last name

Your social security number

Mailing address (number and street or PO box)

Apartment number

City, village, or post office

State

ZIP code

Daytime phone number

Evening phone number

(

)

(

)

Important notes:

– See the instructions, Form IT-285-I, and our Web site for information on the types of relief available.

– By law, the Tax Department must contact the person who was your spouse during the years for which you want relief. There are no

exceptions, even for victims of spousal abuse or domestic violence. Your personal information (such as your current name, address,

and employer) will be protected. However, if you petition the Division of Tax Appeals, your personal information may be released. See

instructions.

1 Are you requesting relief from a liability that resulted from a jointly filed return? Mark an X in the appropriate box.

Yes. Go to line 2.

No. Stop. You cannot file Form IT-285.

2 Are you requesting that all or part of your share of a joint refund, that was (or will be) applied against your spouse’s past-due debt

(such as child support), be refunded to you?

Yes. Stop. Use Form IT-280, Nonobligated Spouse Allocation,

No. Go to line 3.

to make this request. Do not use Form IT-285.

3 Enter the tax year(s) for which you are requesting relief from liability for tax. (Form IT-285 must be

used for tax years beginning on or after January 1, 1999. For relief from a joint liability for prior

years, see General information in the instructions.) ................................................................. 3

Note: If the answers are not the same for each of the following questions for all tax years for which you are filing

this form, submit an explanation (be sure to include your name and social security number).

4 Explain why you believe you qualify for relief. You must submit a statement and appropriate supporting documentation

.

(see instructions)

(continued)

285001140094

1

1 2

2 3

3 4

4