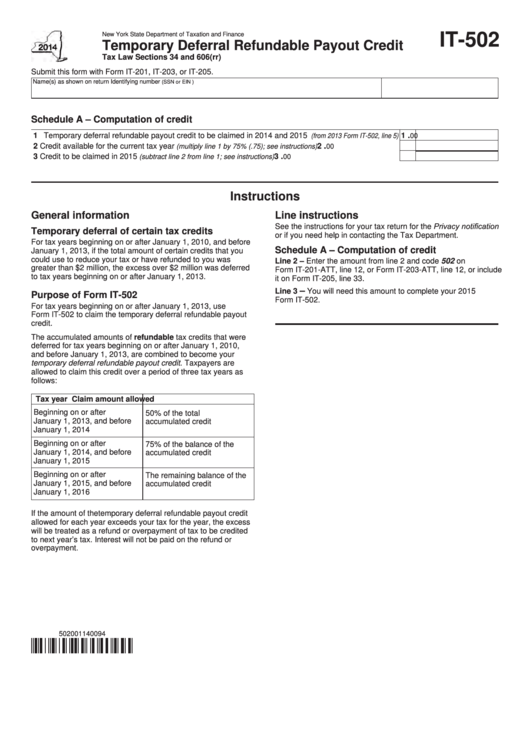

New York State Department of Taxation and Finance

IT-502

Temporary Deferral Refundable Payout Credit

Tax Law Sections 34 and 606(rr)

Submit this form with Form IT-201, IT-203, or IT-205.

Name(s) as shown on return

Identifying number

(SSN or EIN )

Schedule A – Computation of credit

.

1 Temporary deferral refundable payout credit to be claimed in 2014 and 2015

1

(from 2013 Form IT-502, line 5)

00

.

2 Credit available for the current tax year

2

(multiply line 1 by 75% (.75); see instructions) .....................................

00

.

3 Credit to be claimed in 2015

3

(subtract line 2 from line 1; see instructions) ...........................................................

00

Instructions

General information

Line instructions

See the instructions for your tax return for the Privacy notification

Temporary deferral of certain tax credits

or if you need help in contacting the Tax Department.

For tax years beginning on or after January 1, 2010, and before

Schedule A – Computation of credit

January 1, 2013, if the total amount of certain credits that you

could use to reduce your tax or have refunded to you was

Line 2 – Enter the amount from line 2 and code 502 on

greater than $2 million, the excess over $2 million was deferred

Form IT-201-ATT, line 12, or Form IT-203-ATT, line 12, or include

to tax years beginning on or after January 1, 2013.

it on Form IT-205, line 33.

–

Line 3

You will need this amount to complete your 2015

Purpose of Form IT-502

Form IT-502.

For tax years beginning on or after January 1, 2013, use

Form IT-502 to claim the temporary deferral refundable payout

credit.

The accumulated amounts of refundable tax credits that were

deferred for tax years beginning on or after January 1, 2010,

and before January 1, 2013, are combined to become your

temporary deferral refundable payout credit. Taxpayers are

allowed to claim this credit over a period of three tax years as

follows:

Tax year

Claim amount allowed

Beginning on or after

50% of the total

January 1, 2013, and before

accumulated credit

January 1, 2014

Beginning on or after

75% of the balance of the

January 1, 2014, and before

accumulated credit

January 1, 2015

Beginning on or after

The remaining balance of the

January 1, 2015, and before

accumulated credit

January 1, 2016

If the amount of the temporary deferral refundable payout credit

allowed for each year exceeds your tax for the year, the excess

will be treated as a refund or overpayment of tax to be credited

to next year’s tax. Interest will not be paid on the refund or

overpayment.

502001140094

1

1