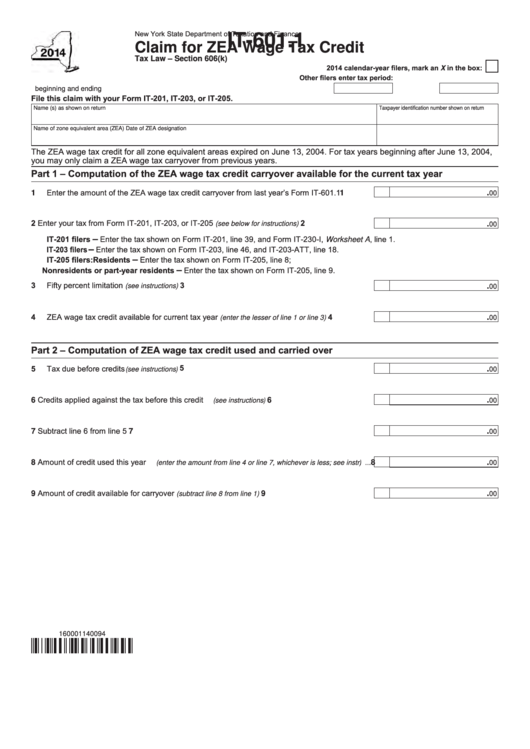

New York State Department of Taxation and Finance

IT-601.1

Claim for ZEA Wage Tax Credit

Tax Law – Section 606(k)

2014 calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

File this claim with your Form IT-201, IT-203, or IT-205.

Taxpayer identification number shown on return

Name (s) as shown on return

Name of zone equivalent area (ZEA)

Date of ZEA designation

The ZEA wage tax credit for all zone equivalent areas expired on June 13, 2004. For tax years beginning after June 13, 2004,

you may only claim a ZEA wage tax carryover from previous years.

Part 1 – Computation of the ZEA wage tax credit carryover available for the current tax year

Enter the amount of the ZEA wage tax credit carryover from last year’s Form IT-601.1 ..............

.

1

1

00

2

Enter your tax from Form IT-201, IT-203, or IT-205

.............................

2

.

(see below for instructions)

00

IT-201 filers

Enter the tax shown on Form IT-201, line 39, and Form IT-230-I, Worksheet A, line 1.

–

IT-203 filers

Enter the tax shown on Form IT-203, line 46, and IT-203-ATT, line 18.

–

IT-205 filers: Residents

Enter the tax shown on Form IT-205, line 8;

–

Nonresidents or part-year residents

Enter the tax shown on Form IT-205, line 9.

–

3

Fifty percent limitation

........................................................................................

3

.

(see instructions)

00

4

ZEA wage tax credit available for current tax year

....................

4

.

(enter the lesser of line 1 or line 3)

00

Part 2 – Computation of ZEA wage tax credit used and carried over

5

5

Tax due before credits

........................................................................................

.

(see instructions)

00

Credits applied against the tax before this credit

(see instructions) .....................................................

.

6

6

00

Subtract line 6 from line 5

.........................................................................................................................

.

7

7

00

Amount of credit used this year

(enter the amount from line 4 or line 7, whichever is less; see instr.) ...

.

8

8

00

Amount of credit available for carryover

(subtract line 8 from line 1) ....................................................

.

9

9

00

160001140094

1

1 2

2