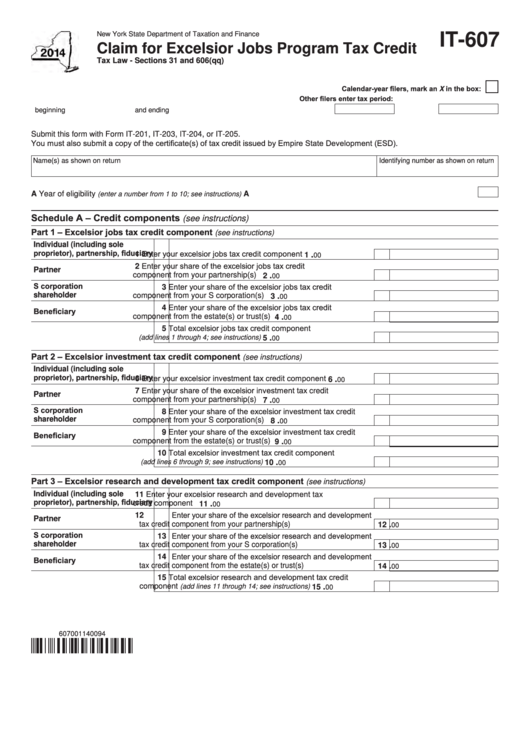

New York State Department of Taxation and Finance

IT-607

Claim for Excelsior Jobs Program Tax Credit

Tax Law - Sections 31 and 606(qq)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

and ending

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

You must also submit a copy of the certificate(s) of tax credit issued by Empire State Development (ESD).

Name(s) as shown on return

Identifying number as shown on return

A Year of eligibility

..................................................................................................... A

(enter a number from 1 to 10; see instructions)

Schedule A – Credit components

(see instructions)

Part 1 – Excelsior jobs tax credit component

(see instructions)

Individual (including sole

proprietor), partnership, fiduciary

1 Enter your excelsior jobs tax credit component .................

.

1

00

2 Enter your share of the excelsior jobs tax credit

Partner

component from your partnership(s) ..............................

.

2

00

S corporation

3 Enter your share of the excelsior jobs tax credit

shareholder

component from your S corporation(s) ..........................

.

3

00

4 Enter your share of the excelsior jobs tax credit

Beneficiary

component from the estate(s) or trust(s) ........................

.

4

00

5 Total excelsior jobs tax credit component

...............................

(add lines 1 through 4; see instructions)

.

5

00

Part 2 – Excelsior investment tax credit component

(see instructions)

Individual (including sole

proprietor), partnership, fiduciary

6 Enter your excelsior investment tax credit component ......

.

6

00

7 Enter your share of the excelsior investment tax credit

Partner

component from your partnership(s) ..............................

.

7

00

S corporation

8 Enter your share of the excelsior investment tax credit

shareholder

component from your S corporation(s) ..........................

.

8

00

9 Enter your share of the excelsior investment tax credit

Beneficiary

component from the estate(s) or trust(s) ........................

.

9

00

10 Total excelsior investment tax credit component

............................... 10

.

(add lines 6 through 9; see instructions)

00

Part 3 – Excelsior research and development tax credit component

(see instructions)

11 Enter your excelsior research and development tax

Individual (including sole

proprietor), partnership, fiduciary

credit component ........................................................... 11

.

00

12 Enter your share of the excelsior research and development

Partner

tax credit component from your partnership(s) .................... 12

.

00

S corporation

13 Enter your share of the excelsior research and development

shareholder

tax credit component from your S corporation(s) ................. 13

.

00

14 Enter your share of the excelsior research and development

Beneficiary

tax credit component from the estate(s) or trust(s) ............. 14

.

00

15 Total excelsior research and development tax credit

component

......... 15

.

(add lines 11 through 14; see instructions)

00

607001140094

1

1 2

2 3

3