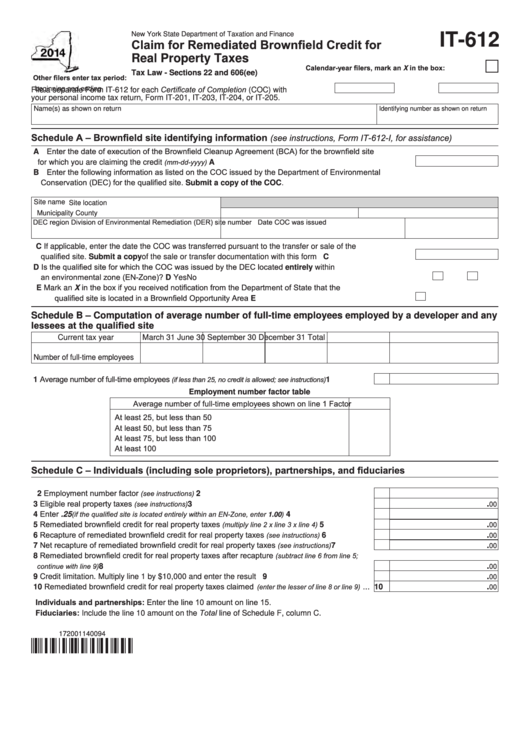

New York State Department of Taxation and Finance

IT-612

Claim for Remediated Brownfield Credit for

Real Property Taxes

Calendar-year filers, mark an X in the box:

Tax Law - Sections 22 and 606(ee)

Other filers enter tax period:

File a separate Form IT-612 for each Certificate of Completion (COC) with

beginning

and ending

your personal income tax return, Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Identifying number as shown on return

Schedule A – Brownfield site identifying information

(see instructions, Form IT-612-I, for assistance)

A Enter the date of execution of the Brownfield Cleanup Agreement (BCA) for the brownfield site

(mm-dd-yyyy)

for which you are claiming the credit

.............................................................................. A

B Enter the following information as listed on the COC issued by the Department of Environmental

Conservation (DEC) for the qualified site. Submit a copy of the COC.

Site name

Site location

Municipality

County

DEC region

Division of Environmental Remediation (DER) site number Date COC was issued

C If applicable, enter the date the COC was transferred pursuant to the transfer or sale of the

qualified site. Submit a copy of the sale or transfer documentation with this form ............................ C

D Is the qualified site for which the COC was issued by the DEC located entirely within

an environmental zone (EN-Zone)? .................................................................................................... D

Yes

No

E Mark an X in the box if you received notification from the Department of State that the

qualified site is located in a Brownfield Opportunity Area ................................................................... E

Schedule B – Computation of average number of full-time employees employed by a developer and any

lessees at the qualified site

March 31

June 30

September 30

December 31

Total

Current tax year

Number of full-time employees

1 Average number of full-time employees

(if less than 25, no credit is allowed; see instructions)

..................

1

Employment number factor table

Average number of full-time employees shown on line 1

Factor

At least 25, but less than 50 ..............................................................

.25

At least 50, but less than 75 ..............................................................

.50

At least 75, but less than 100 ............................................................

.75

At least 100 .......................................................................................

1.00

Schedule C – Individuals (including sole proprietors), partnerships, and fiduciaries

2 Employment number factor

(see instructions)

...............................................................................

2

3 Eligible real property taxes

(see instructions)

.

.................................................................................

3

00

4 Enter .25

(if the qualified site is located entirely within an EN-Zone, enter 1.00)

....................................

4

5 Remediated brownfield credit for real property taxes

(multiply line 2 x line 3 x line 4)

.

....................

5

00

6 Recapture of remediated brownfield credit for real property taxes

(see instructions)

.

...................

6

00

7 Net recapture of remediated brownfield credit for real property taxes

(see instructions)

.

...............

7

00

8 Remediated brownfield credit for real property taxes after recapture

(subtract line 6 from line 5;

continue with line 9)

.

.....................................................................................................................

8

00

.

9 Credit limitation. Multiply line 1 by $10,000 and enter the result ................................................

9

00

10 Remediated brownfield credit for real property taxes claimed

(enter the lesser of line 8 or line 9)

.

...

10

00

Individuals and partnerships: Enter the line 10 amount on line 15.

Fiduciaries: Include the line 10 amount on the Total line of Schedule F, column C.

172001140094

1

1 2

2