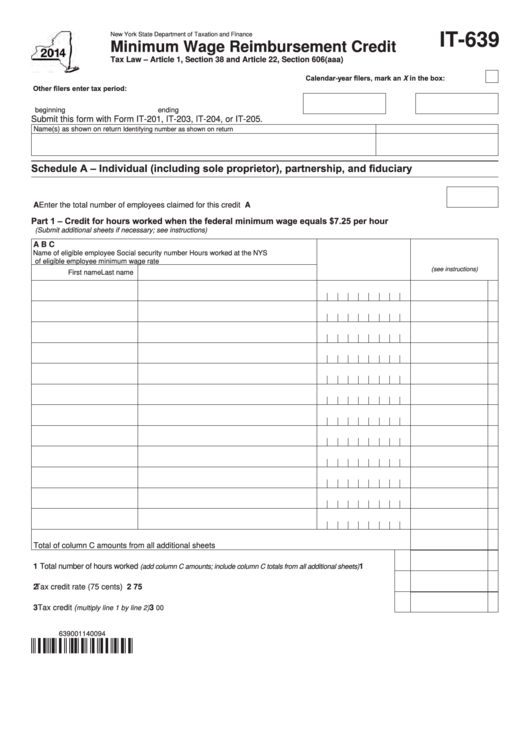

New York State Department of Taxation and Finance

IT-639

Minimum Wage Reimbursement Credit

Tax Law – Article 1, Section 38 and Article 22, Section 606(aaa)

Calendar-year filers, mark an X in the box:

Other filers enter tax period:

beginning

ending

Submit this form with Form IT‑201, IT‑203, IT‑204, or IT‑205.

Name(s) as shown on return

Identifying number as shown on return

Schedule A – Individual (including sole proprietor), partnership, and fiduciary

A Enter the total number of employees claimed for this credit ........................................................................................ A

Part 1 – Credit for hours worked when the federal minimum wage equals $7.25 per hour

(Submit additional sheets if necessary; see instructions)

A

B

C

Name of eligible employee

Social security number

Hours worked at the NYS

of eligible employee

minimum wage rate

(see instructions)

First name

Last name

Total of column C amounts from all additional sheets ........................................................................................

1 Total number of hours worked

...............

1

(add column C amounts; include column C totals from all additional sheets)

2 Tax credit rate (75 cents) .........................................................................................................................

2

75

3 Tax credit (

..............................................................................................................

3

multiply line 1 by line 2)

00

639001140094

1

1 2

2 3

3