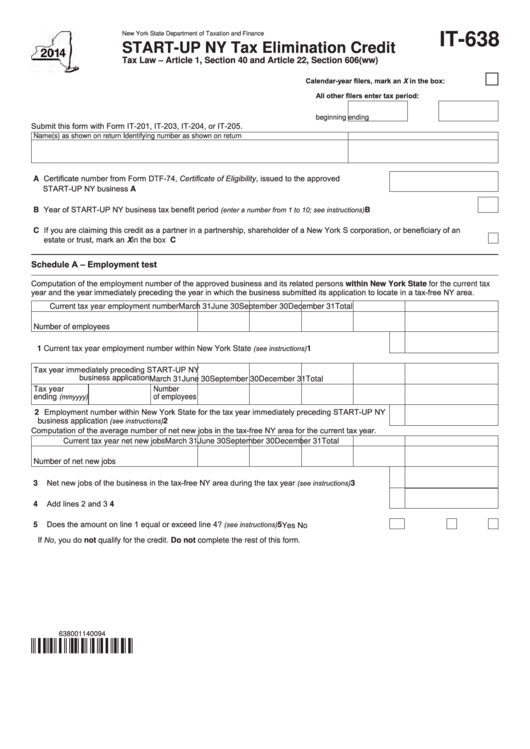

New York State Department of Taxation and Finance

IT-638

START-UP NY Tax Elimination Credit

Tax Law – Article 1, Section 40 and Article 22, Section 606(ww)

Calendar-year filers, mark an X in the box:

All other filers enter tax period:

beginning

ending

Submit this form with Form IT-201, IT-203, IT-204, or IT-205.

Name(s) as shown on return

Identifying number as shown on return

A Certificate number from Form DTF-74, Certificate of Eligibility, issued to the approved

START-UP NY business ................................................................................................................ A

B Year of START-UP NY business tax benefit period

................................................. B

(enter a number from 1 to 10; see instructions)

C If you are claiming this credit as a partner in a partnership, shareholder of a New York S corporation, or beneficiary of an

estate or trust, mark an X in the box ............................................................................................................................................ C

Schedule A – Employment test

Computation of the employment number of the approved business and its related persons within New York State for the current tax

year and the year immediately preceding the year in which the business submitted its application to locate in a tax-free NY area.

Current tax year employment number

March 31

June 30

September 30 December 31

Total

Number of employees ......................................

1 Current tax year employment number within New York State

...................................

(see instructions)

1

Tax year immediately preceding START-UP NY

business application

March 31

June 30

September 30 December 31

Total

Tax year

Number

ending

of employees

(mmyyyy)

2 Employment number within New York State for the tax year immediately preceding START-UP NY

business application

................................................................................................

(see instructions)

2

Computation of the average number of net new jobs in the tax-free NY area for the current tax year.

Current tax year net new jobs

March 31

June 30

September 30 December 31

Total

Number of net new jobs ...................................

3 Net new jobs of the business in the tax-free NY area during the tax year

................

(see instructions)

3

4 Add lines 2 and 3 ................................................................................................................................

4

5 Does the amount on line 1 equal or exceed line 4?

..................................................

(see instructions)

Yes

No

5

If No, you do not qualify for the credit. Do not complete the rest of this form.

638001140094

1

1 2

2 3

3