PRINT FORM

CLEAR FIELDS

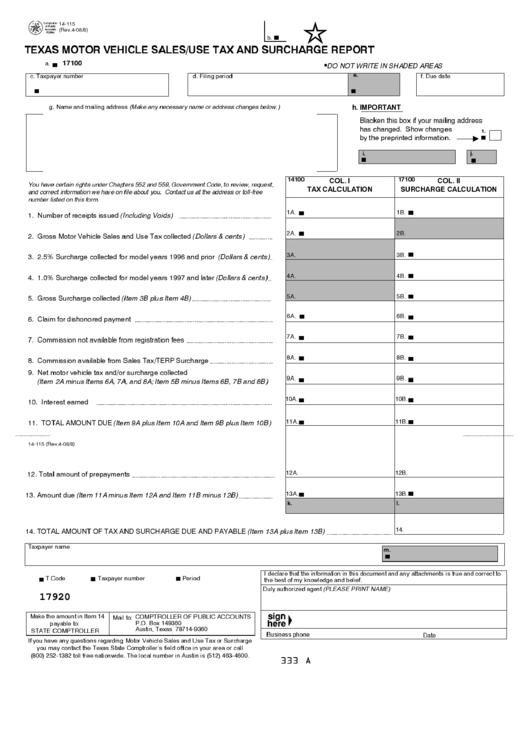

14-115

(Rev.4-08/8)

b.

TEXAS MOTOR VEHICLE SALES/USE TAX AND SURCHARGE REPORT

17100

a.

DO NOT WRITE IN SHADED AREAS

e.

c. Taxpayer number

d. Filing period

f. Due date

h. IMPORTANT

g. Name and mailing address (Make any necessary name or address changes below.)

Blacken this box if your mailing address

has changed. Show changes

1.

by the preprinted information.

j.

i.

14100

17100

COL. I

COL. II

You have certain rights under Chapters 552 and 559, Government Code, to review, request,

TAX CALCULATION

SURCHARGE CALCULATION

and correct information we have on file about you. Contact us at the address or toll-free

number listed on this form.

1A.

1B.

1. Number of receipts issued (Including Voids)

2A.

2B.

2. Gross Motor Vehicle Sales and Use Tax collected (Dollars & cents)

3A.

3B.

3. 2.5% Surcharge collected for model years 1996 and prior (Dollars & cents)

4A.

4B.

4. 1.0% Surcharge collected for model years 1997 and later (Dollars & cents)

5A.

5B.

5. Gross Surcharge collected (Item 3B plus Item 4B)

6A.

6B.

6. Claim for dishonored payment

7A.

7B.

7. Commission not available from registration fees

8A.

8B.

8. Commission available from Sales Tax/TERP Surcharge

9. Net motor vehicle tax and/or surcharge collected

9A.

9B.

(Item 2A minus Items 6A, 7A, and 8A; Item 5B minus Items 6B, 7B and 8B)

10A.

10B.

10. Interest earned

11A.

11B.

11. TOTAL AMOUNT DUE (Item 9A plus Item 10A and Item 9B plus Item 10B)

14-115 (Rev.4-08/8)

12. Total amount of prepayments

12A.

12B.

13. Amount due (Item 11A minus Item 12A and Item 11B minus 12B)

13A.

13B.

k.

l.

14.

14. TOTAL AMOUNT OF TAX AND SURCHARGE DUE AND PAYABLE (Item 13A plus Item 13B)

Taxpayer name

m.

I declare that the information in this document and any attachments is true and correct to

T Code

Taxpayer number

Period

the best of my knowledge and belief.

Duly authorized agent (PLEASE PRINT NAME)

17920

Make the amount in Item 14

COMPTROLLER OF PUBLIC ACCOUNTS

Mail to:

P.O. Box 149360

payable to:

Austin, Texas 78714-9360

STATE COMPTROLLER

Business phone

Date

If you have any questions regarding Motor Vehicle Sales and Use Tax or Surcharge

you may contact the Texas State Comptroller's field office in your area or call

(800) 252-1382 toll free nationwide. The local number in Austin is (512) 463-4600.

333 A

1

1 2

2