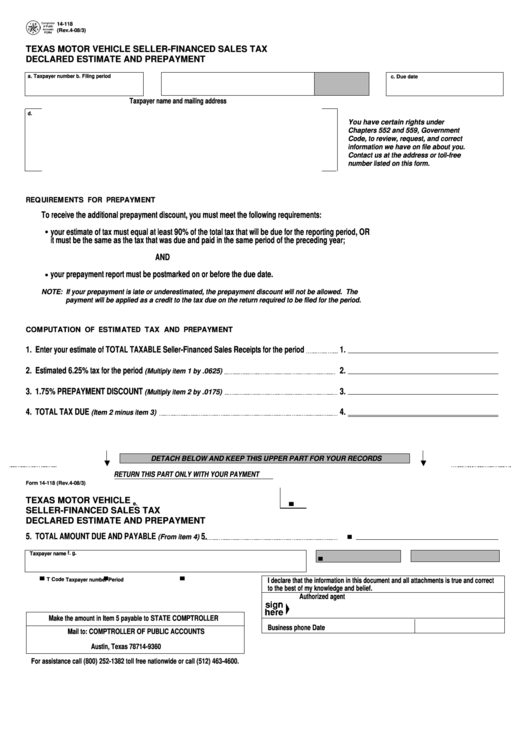

14-118

(Rev.4-08/3)

TEXAS MOTOR VEHICLE SELLER-FINANCED SALES TAX

DECLARED ESTIMATE AND PREPAYMENT

a. Taxpayer number

b. Filing period

c. Due date

Taxpayer name and mailing address

d.

You have certain rights under

Chapters 552 and 559, Government

Code, to review, request, and correct

information we have on file about you.

Contact us at the address or toll-free

number listed on this form.

REQUIREMENTS FOR PREPAYMENT

To receive the additional prepayment discount, you must meet the following requirements:

your estimate of tax must equal at least 90% of the total tax that will be due for the reporting period, OR

it must be the same as the tax that was due and paid in the same period of the preceding year;

AND

your prepayment report must be postmarked on or before the due date.

NOTE: If your prepayment is late or underestimated, the prepayment discount will not be allowed. The

payment will be applied as a credit to the tax due on the return required to be filed for the period.

COMPUTATION OF ESTIMATED TAX AND PREPAYMENT

1. Enter your estimate of TOTAL TAXABLE Seller-Financed Sales Receipts for the period

1.

2. Estimated 6.25% tax for the period

2.

(Multiply item 1 by .0625)

3. 1.75% PREPAYMENT DISCOUNT

3.

(Multiply item 2 by .0175)

4. TOTAL TAX DUE

4.

(Item 2 minus item 3)

DETACH BELOW AND KEEP THIS UPPER PART FOR YOUR RECORDS

RETURN THIS PART ONLY WITH YOUR PAYMENT

Form 14-118 (Rev.4-08/3)

TEXAS MOTOR VEHICLE

e.

SELLER-FINANCED SALES TAX

DECLARED ESTIMATE AND PREPAYMENT

5. TOTAL AMOUNT DUE AND PAYABLE

5.

(From item 4)

f.

g.

Taxpayer name

T Code

I declare that the information in this document and all attachments is true and correct

Taxpayer number

Period

to the best of my knowledge and belief.

Authorized agent

Make the amount in Item 5 payable to STATE COMPTROLLER

Business phone

Date

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

P.O. Box 149360

Austin, Texas 78714-9360

For assistance call (800) 252-1382 toll free nationwide or call (512) 463-4600.

1

1