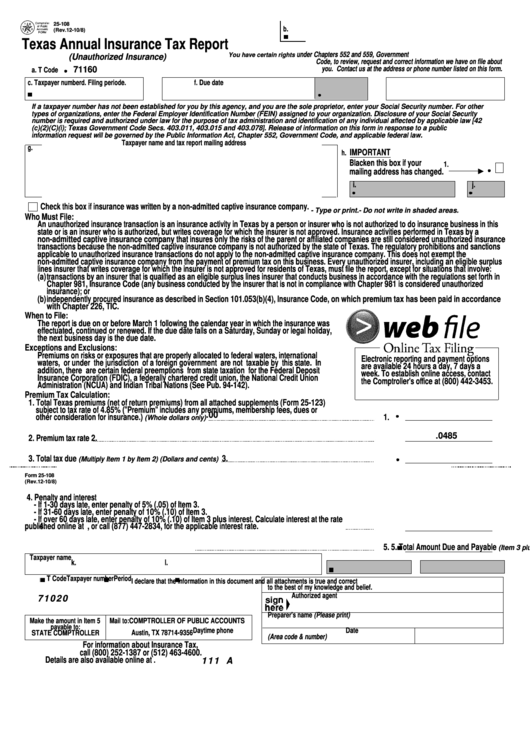

25-108

b.

PRINT FORM

CLEAR FIELDS

(Rev.12-10/8)

Texas Annual Insurance Tax Report

under Chapters 552 and 559, Government

You have certain rights

(Unauthorized Insurance)

Code, to review, request and correct information we have on file about

71160

you. Contact us at the address or phone number listed on this form.

a. T Code

e.

c. Taxpayer number

d. Filing period

f. Due date

If a taxpayer number has not been established for you by this agency, and you are the sole proprietor, enter your Social Security number. For other

types of organizations, enter the Federal Employer Identification Number (FEIN) assigned to your organization. Disclosure of your Social Security

number is required and authorized under law for the purpose of tax administration and identification of any individual affected by applicable law [42

U.S.C. Sec. 405(c)(2)(C)(i); Texas Government Code Secs. 403.011, 403.015 and 403.078]. Release of information on this form in response to a public

information request will be governed by the Public Information Act, Chapter 552, Government Code, and applicable federal law.

Taxpayer name and tax report mailing address

g.

IMPORTANT

h.

Blacken this box if your

1.

mailing address has changed.

i.

j.

Check this box if insurance was written by a non-admitted captive insurance company.

- Type or print.

- Do not write in shaded areas.

Who Must File:

An unauthorized insurance transaction is an insurance activity in Texas by a person or insurer who is not authorized to do insurance business in this

state or is an insurer who is authorized, but writes coverage for which the insurer is not approved. Insurance activities performed in Texas by a

non-admitted captive insurance company that insures only the risks of the parent or affiliated companies are still considered unauthorized insurance

transactions because the non-admitted captive insurance company is not authorized by the state of Texas. The regulatory prohibitions and sanctions

applicable to unauthorized insurance transactions do not apply to the non-admitted captive insurance company. This does not exempt the

non-admitted captive insurance company from the payment of premium tax on this business. Every unauthorized insurer, including an eligible surplus

lines insurer that writes coverage for which the insurer is not approved for residents of Texas, must file the report, except for situations that involve:

(a)

transactions by an insurer that is qualified as an eligible surplus lines insurer that conducts business in accordance with the regulations set forth in

Chapter 981, Insurance Code (any business conducted by the insurer that is not in compliance with Chapter 981 is considered unauthorized

insurance); or

(b)

independently procured insurance as described in Section 101.053(b)(4), Insurance Code, on which premium tax has been paid in accordance

with Chapter 226, TIC.

When to File:

The report is due on or before March 1 following the calendar year in which the insurance was

effectuated, continued or renewed. If the due date falls on a Saturday, Sunday or legal holiday,

the next business day is the due date.

Exceptions and Exclusions:

Premiums on risks or exposures that are properly allocated to federal waters, international

Electronic reporting and payment options

waters, or under the jurisdiction of a foreign government are not taxable by this state. In

are available 24 hours a day, 7 days a

addition, there are certain federal preemptions from state taxation for the Federal Deposit

week. To establish online access, contact

Insurance Corporation (FDIC), a federally chartered credit union, the National Credit Union

the Comptroller's office at (800) 442-3453.

Administration (NCUA) and Indian Tribal Nations (See Pub. 94-142).

Premium Tax Calculation:

1. Total Texas premiums (net of return premiums) from all attached supplements (Form 25-123)

subject to tax rate of 4.85% ("Premium" includes any premiums, membership fees, dues or

.00

other consideration for insurance.)

1.

(Whole dollars only)

.0485

2. Premium tax rate

2.

3. Total tax due

3.

(Multiply Item 1 by Item 2) (Dollars and cents)

Form 25-108

(Rev.12-10/8)

4. Penalty and interest

- If 1-30 days late, enter penalty of 5% (.05) of Item 3.

- If 31-60 days late, enter penalty of 10% (.10) of Item 3.

- If over 60 days late, enter penalty of 10% (.10) of Item 3 plus interest. Calculate interest at the rate

4.

published online at , or call (877) 447-2834, for the applicable interest rate.

5. Total Amount Due and Payable

5.

(Item 3 plus Item 4)

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

71020

Preparer's name (Please print)

Make the amount in Item 5

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9356

(Area code & number)

For information about Insurance Tax,

call (800) 252-1387 or (512) 463-4600.

Details are also available online at .

111 A

1

1 2

2