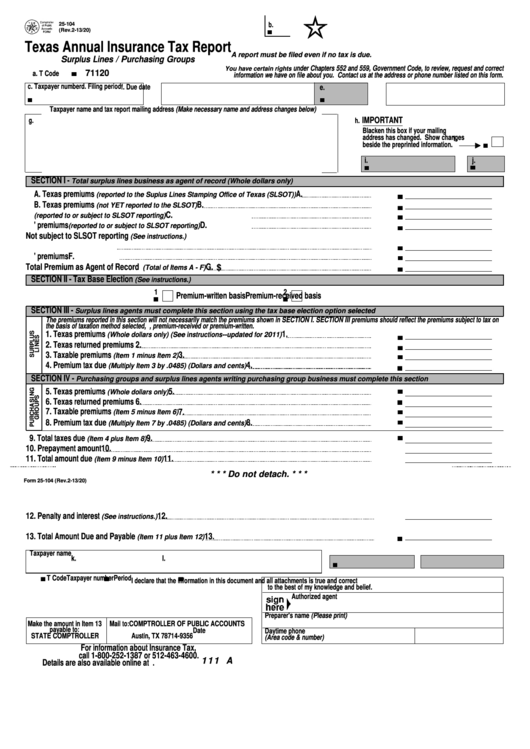

25-104

b.

(Rev.2-13/20)

PRINT FORM

RESET FORM

Texas Annual Insurance Tax Report

A report must be filed even if no tax is due.

Surplus Lines / Purchasing Groups

under Chapters 552 and 559, Government Code, to review, request and correct

You have certain rights

71120

a. T Code

information we have on file about you. Contact us at the address or phone number listed on this form.

c. Taxpayer number

d. Filing period

e.

f. Due date

Taxpayer name and tax report mailing address (Make necessary name and address changes below)

IMPORTANT

h.

g.

Blacken this box if your mailing

address has changed. Show changes

1.

beside the preprinted information.

i.

j.

SECTION I -

Total surplus lines business as agent of record (Whole dollars only)

A. Texas premiums

A.

(reported to the Suplus Lines Stamping Office of Texas (SLSOT))

B. Texas premiums

B.

(not YET reported to the SLSOT)

C. Non-taxable premiums

C.

(reported to or subject to SLSOT reporting)

D. Other states' premiums

D.

(reported to or subject to SLSOT reporting)

Not subject to SLSOT reporting

(See instructions.)

E. Non-taxable premiums

E.

F. Other states' premiums

F.

Total Premium as Agent of Record

G. $

(Total of Items A - F)

SECTION II - Tax Base Election

(See instructions.)

1

2

Premium-written basis

Premium-received basis

SECTION III -

Surplus lines agents must complete this section using the tax base election option selected

The premiums reported in this section will not necessarily match the premiums shown in SECTION I. SECTION III premiums should reflect the premiums subject to tax on

the basis of taxation method selected, i.e., premium-received or premium-written.

1. Texas premiums

1.

(Whole dollars only) (See instructions--updated for 2011)

2. Texas returned premiums

2.

3. Taxable premiums

3.

(Item 1 minus Item 2)

4. Premium tax due

4.

(Multiply Item 3 by .0485) (Dollars and cents)

SECTION IV -

Purchasing groups and surplus lines agents writing purchasing group business must complete this section

5. Texas premiums

5.

(Whole dollars only)

6. Texas returned premiums

6.

7. Taxable premiums

7.

(Item 5 minus Item 6)

8. Premium tax due

8.

(Multiply Item 7 by .0485) (Dollars and cents)

9. Total taxes due

9.

(Item 4 plus Item 8)

10. Prepayment amount

10.

11. Total amount due

11.

(Item 9 minus Item 10)

* * * Do not detach. * * *

Form 25-104 (Rev.2-13/20)

12. Penalty and interest

12.

(See instructions.)

13. Total Amount Due and Payable

13.

(Item 11 plus Item 12)

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

to the best of my knowledge and belief.

Authorized agent

Preparer's name (Please print)

Make the amount in Item 13

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Date

Daytime phone

STATE COMPTROLLER

Austin, TX 78714-9356

(Area code & number)

For information about Insurance Tax,

call 1-800-252-1387 or 512-463-4600.

111 A

Details are also available online at

1

1 2

2