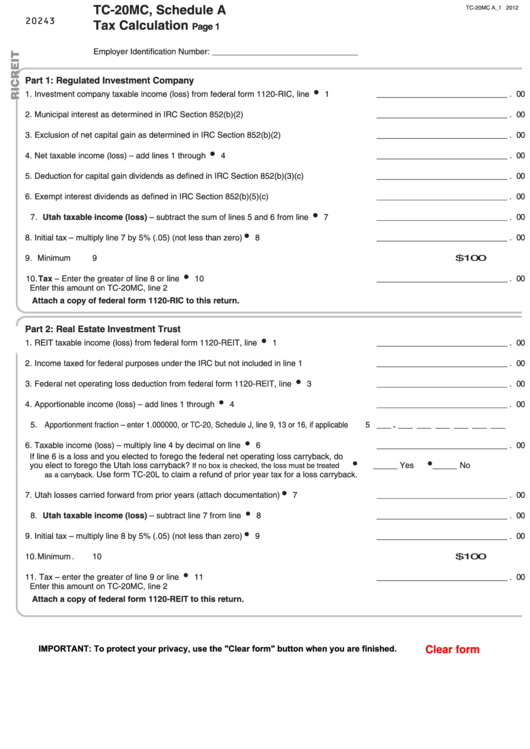

TC-20MC, Schedule A

TC-20MC A_1 2012

20243

Tax Calculation

Page 1

Employer Identification Number: _ ___ ___ ___ __ ___ ___ _

Part 1: Regulated Investment Company

1. Investment company taxable income (loss) from federal form 1120-RIC, line 26 .......

1 __ ___ ___ ___ _ _ _ _ _ _ . 00

2. Municipal interest as determined in IRC Section 852(b)(2) ........................................

2 __ ___ ___ ___ _ _ _ _ _ _ . 00

3. Exclusion of net capital gain as determined in IRC Section 852(b)(2)........................

3 __ ___ ___ ___ _ _ _ _ _ _ . 00

4. Net taxable income (loss) – add lines 1 through 3......................................................

4 _ ___ ___ ___ _ _ _ _ _ _ _ . 00

5. Deduction for capital gain dividends as defined in IRC Section 852(b)(3)(c)..............

5 __ ___ ___ ___ _ _ _ _ _ _ . 00

6. Exempt interest dividends as defined in IRC Section 852(b)(5)(c) .............................

6 __ ___ ___ ___ _ _ _ _ _ _ . 00

7. Utah taxable income (loss) – subtract the sum of lines 5 and 6 from line 4.............

7 __ ___ ___ ___ _ _ _ _ _ _ . 00

8. Initial tax – multiply line 7 by 5% (.05) (not less than zero) .........................................

8 __ ___ ___ ___ _ _ _ _ _ _ . 00

9. Minimum tax................................................................................................................

9

$ 100

10. Tax – Enter the greater of line 8 or line 9....................................................................

10 _ ___ ___ ___ __ _ _ _ _ _ . 00

Enter this amount on TC-20MC, line 2

Attach a copy of federal form 1120-RIC to this return.

Part 2: Real Estate Investment Trust

1. REIT taxable income (loss) from federal form 1120-REIT, line 22 ..............................

1 __ ___ ___ ___ _ _ _ _ _ _ . 00

2. Income taxed for federal purposes under the IRC but not included in line 1 above....

2 ___ ___ ___ ___ _ _ _ _ _ . 00

3. Federal net operating loss deduction from federal form 1120-REIT, line 21a .............

3 __ ___ ___ ___ _ _ _ _ _ _ . 00

4. Apportionable income (loss) – add lines 1 through 3..................................................

4 _ ___ ___ ___ _ _ _ _ _ _ _ . 00

5. Apportionment fraction – enter 1.000000, or TC-20, Schedule J, line 9, 13 or 16, if applicable

5 __ . __ __ __ __ __ __

6. Taxable income (loss) – multiply line 4 by decimal on line 5.......................................

6 __ ___ ___ ___ _ _ _ _ _ _ . 00

If line 6 is a loss and you elected to forego the federal net operating loss carryback, do

you elect to forego the Utah loss carryback?

___ Yes

__ _ No

If no box is checked, the loss must be treated

Use form TC-20L to claim a refund of prior year tax for a loss carryback.

as a carryback.

7. Utah losses carried forward from prior years (attach documentation) ........................

7 __ ___ ___ ___ _ _ _ _ _ _ . 00

8. Utah taxable income (loss) – subtract line 7 from line 6. .........................................

8 ___ ___ ___ ___ _ _ _ _ _ . 00

9. Initial tax – multiply line 8 by 5% (.05) (not less than zero) .........................................

9 __ ___ ___ ___ _ _ _ _ _ _ . 00

10. Minimum tax................................................................................................................

10

$ 100

11. Tax – enter the greater of line 9 or line 10 ..................................................................

11 ___ ___ ___ __ _ _ _ _ _ _ . 00

Enter this amount on TC-20MC, line 2

Attach a copy of federal form 1120-REIT to this return.

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1 2

2