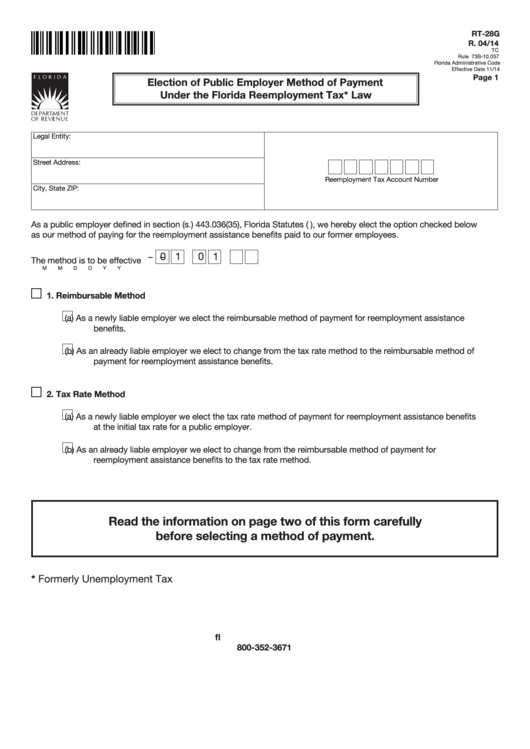

Form Rt-28g - Election Of Public Employer Method Of Payment Under The Florida Reemployment Tax* Law

ADVERTISEMENT

RT-28G

R. 04/14

TC

Rule 73B-10.037

Florida Administrative Code

Effective Date 11/14

Page 1

Election of Public Employer Method of Payment

Under the Florida Reemployment Tax* Law

Legal Entity:

Street Address:

Reemployment Tax Account Number

City, State ZIP:

As a public employer defined in section (s.) 443.036(35), Florida Statutes (F.S.), we hereby elect the option checked below

as our method of paying for the reemployment assistance benefits paid to our former employees.

0

0

1

1

–

–

The method is to be effective

M

M

D

D

Y

Y

1. Reimbursable Method

(a) As a newly liable employer we elect the reimbursable method of payment for reemployment assistance

benefits.

(b) As an already liable employer we elect to change from the tax rate method to the reimbursable method of

payment for reemployment assistance benefits.

2. Tax Rate Method

(a) As a newly liable employer we elect the tax rate method of payment for reemployment assistance benefits

at the initial tax rate for a public employer.

(b) As an already liable employer we elect to change from the reimbursable method of payment for

reemployment assistance benefits to the tax rate method.

Read the information on page two of this form carefully

before selecting a method of payment.

* Formerly Unemployment Tax

800-352-3671

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2