Form Pa-131 - Manufacturer'S Form Of Objection To Personal Property Assessment

ADVERTISEMENT

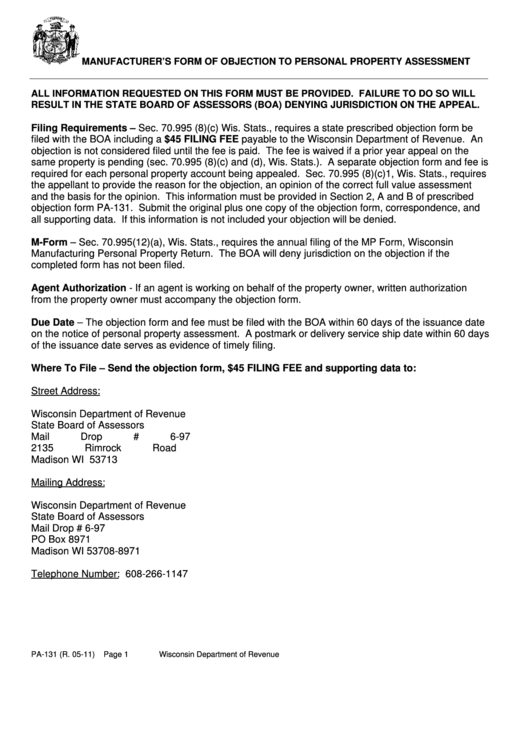

MANUFACTURER’S FORM OF OBJECTION TO PERSONAL PROPERTY ASSESSMENT

ALL INFORMATION REQUESTED ON THIS FORM MUST BE PROVIDED. FAILURE TO DO SO WILL

RESULT IN THE STATE BOARD OF ASSESSORS (BOA) DENYING JURISDICTION ON THE APPEAL.

Filing Requirements – Sec. 70.995 (8)(c) Wis. Stats., requires a state prescribed objection form be

filed with the BOA including a $45 FILING FEE payable to the Wisconsin Department of Revenue. An

objection is not considered filed until the fee is paid. The fee is waived if a prior year appeal on the

same property is pending (sec. 70.995 (8)(c) and (d), Wis. Stats.). A separate objection form and fee is

required for each personal property account being appealed. Sec. 70.995 (8)(c)1, Wis. Stats., requires

the appellant to provide the reason for the objection, an opinion of the correct full value assessment

and the basis for the opinion. This information must be provided in Section 2, A and B of prescribed

objection form PA-131. Submit the original plus one copy of the objection form, correspondence, and

all supporting data. If this information is not included your objection will be denied.

M-Form – Sec. 70.995(12)(a), Wis. Stats., requires the annual filing of the MP Form, Wisconsin

Manufacturing Personal Property Return. The BOA will deny jurisdiction on the objection if the

completed form has not been filed.

Agent Authorization - If an agent is working on behalf of the property owner, written authorization

from the property owner must accompany the objection form.

Due Date – The objection form and fee must be filed with the BOA within 60 days of the issuance date

on the notice of personal property assessment. A postmark or delivery service ship date within 60 days

of the issuance date serves as evidence of timely filing.

Where To File – Send the objection form, $45 FILING FEE and supporting data to:

Street Address:

Wisconsin Department of Revenue

State Board of Assessors

Mail Drop # 6-97

2135 Rimrock Road

Madison WI 53713

Mailing Address:

Wisconsin Department of Revenue

State Board of Assessors

Mail Drop # 6-97

PO Box 8971

Madison WI 53708-8971

Telephone Number: 608-266-1147

PA-131 (R. 05-11)

Page 1

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2