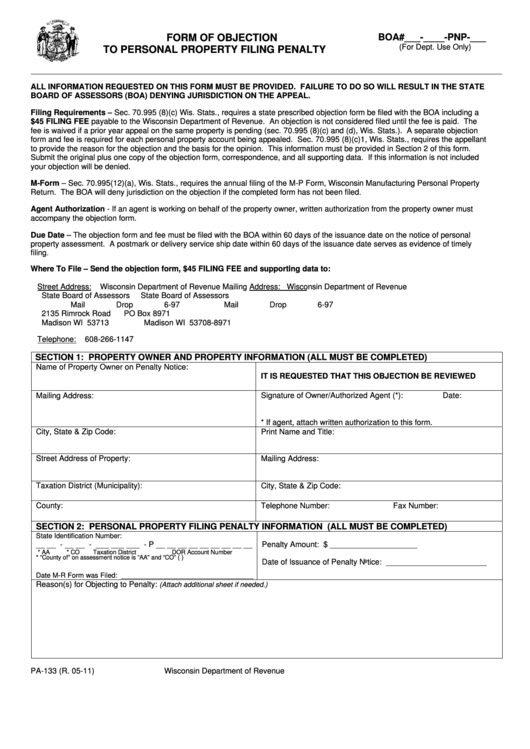

Form Pa-133 - Form Of Objection To Personal Property Filing Penalty

ADVERTISEMENT

BOA#___-____-PNP-___

FORM OF OBJECTION

(For Dept. Use Only)

TO PERSONAL PROPERTY FILING PENALTY

ALL INFORMATION REQUESTED ON THIS FORM MUST BE PROVIDED. FAILURE TO DO SO WILL RESULT IN THE STATE

BOARD OF ASSESSORS (BOA) DENYING JURISDICTION ON THE APPEAL.

Filing Requirements – Sec. 70.995 (8)(c) Wis. Stats., requires a state prescribed objection form be filed with the BOA including a

$45 FILING FEE payable to the Wisconsin Department of Revenue. An objection is not considered filed until the fee is paid. The

fee is waived if a prior year appeal on the same property is pending (sec. 70.995 (8)(c) and (d), Wis. Stats.). A separate objection

form and fee is required for each personal property account being appealed. Sec. 70.995 (8)(c)1, Wis. Stats., requires the appellant

to provide the reason for the objection and the basis for the opinion. This information must be provided in Section 2 of this form.

Submit the original plus one copy of the objection form, correspondence, and all supporting data. If this information is not included

your objection will be denied.

M-Form – Sec. 70.995(12)(a), Wis. Stats., requires the annual filing of the M-P Form, Wisconsin Manufacturing Personal Property

Return. The BOA will deny jurisdiction on the objection if the completed form has not been filed.

Agent Authorization - If an agent is working on behalf of the property owner, written authorization from the property owner must

accompany the objection form.

Due Date – The objection form and fee must be filed with the BOA within 60 days of the issuance date on the notice of personal

property assessment. A postmark or delivery service ship date within 60 days of the issuance date serves as evidence of timely

filing.

Where To File – Send the objection form, $45 FILING FEE and supporting data to:

Street Address:

Wisconsin Department of Revenue

Mailing Address: Wisconsin Department of Revenue

State Board of Assessors

State Board of Assessors

Mail Drop 6-97

Mail Drop 6-97

2135 Rimrock Road

PO Box 8971

Madison WI 53713

Madison WI 53708-8971

Telephone:

608-266-1147

SECTION 1: PROPERTY OWNER AND PROPERTY INFORMATION (ALL MUST BE COMPLETED)

Name of Property Owner on Penalty Notice:

IT IS REQUESTED THAT THIS OBJECTION BE REVIEWED

Mailing Address:

Signature of Owner/Authorized Agent (*):

Date:

* If agent, attach written authorization to this form.

City, State & Zip Code:

Print Name and Title:

Street Address of Property:

Mailing Address:

Taxation District (Municipality):

City, State & Zip Code:

County:

Telephone Number:

Fax Number:

SECTION 2: PERSONAL PROPERTY FILING PENALTY INFORMATION (ALL MUST BE COMPLETED)

State Identification Number:

__ __ - __ __ - ___ ___ ___ - P __ __ __ __ __ __ __ __ __

Penalty Amount: $ ____________________

* AA

* CO

Taxation District

DOR Account Number

* “County of” on assessment notice is “AA” and “CO” (e.g. 76-13)

Date of Issuance of Penalty Notice: _______________________

Date M-R Form was Filed: __________________________________

Reason(s) for Objecting to Penalty:

(Attach additional sheet if needed.)

PA-133 (R. 05-11)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1