1501910051

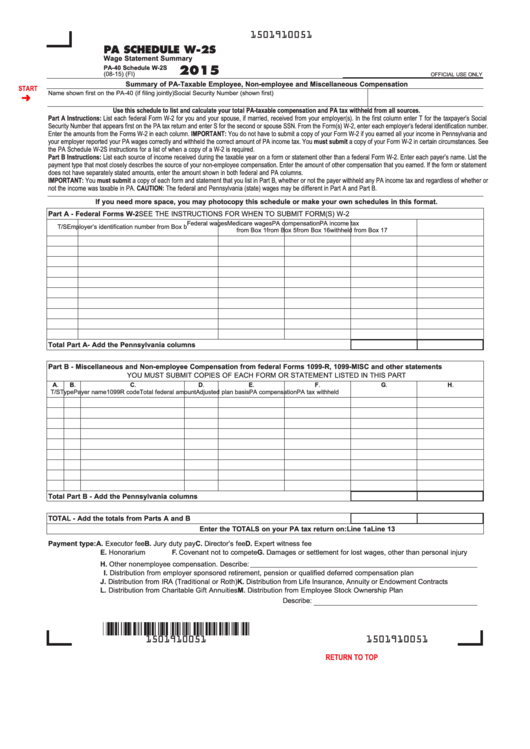

PA SCHEDULE W-2S

Wage Statement Summary

2015

PA-40 Schedule W-2S

(08-15) (FI)

OFFICIAL USE ONLY

Summary of PA-Taxable Employee, Non-employee and Miscellaneous Compensation

START

Name shown first on the PA-40 (if filing jointly)

Social Security Number (shown first)

Use this schedule to list and calculate your total PA-taxable compensation and PA tax withheld from all sources.

Part A Instructions: List each federal Form W-2 for you and your spouse, if married, received from your employer(s). In the first column enter T for the taxpayer’s Social

Security Number that appears first on the PA tax return and enter S for the second or spouse SSN. From the Form(s) W-2, enter each employer’s federal identification number.

Enter the amounts from the Forms W-2 in each column. IMPORTANT: You do not have to submit a copy of your Form W-2 if you earned all your income in Pennsylvania and

your employer reported your PA wages correctly and withheld the correct amount of PA income tax. You must submit a copy of your Form W-2 in certain circumstances. See

the PA Schedule W-2S instructions for a list of when a copy of a W-2 is required.

Part B Instructions: List each source of income received during the taxable year on a form or statement other than a federal Form W-2. Enter each payer’s name. List the

payment type that most closely describes the source of your non-employee compensation. Enter the amount of other compensation that you earned. If the form or statement

does not have separately stated amounts, enter the amount shown in both federal and PA columns.

IMPORTANT: You must submit a copy of each form and statement that you list in Part B, whether or not the payer withheld any PA income tax and regardless of whether or

not the income was taxable in PA. CAUTION: The federal and Pennsylvania (state) wages may be different in Part A and Part B.

If you need more space, you may photocopy this schedule or make your own schedules in this format.

Part A - Federal Forms W-2

SEE THE INSTRUCTIONS FOR WHEN TO SUBMIT FORM(S) W-2

Federal wages

Medicare wages

PA compensation

PA income tax

T/S

Employer’s identification number from Box b

from Box 1

from Box 5

from Box 16

withheld from Box 17

Total Part A- Add the Pennsylvania columns

Part B - Miscellaneous and Non-employee Compensation from federal Forms 1099-R, 1099-MISC and other statements

YOU MUST SUBMIT COPIES OF EACH FORM OR STATEMENT LISTED IN THIS PART

A.

B.

C.

D.

E.

F.

G.

H.

T/S Type

Payer name

1099R code Total federal amount

Adjusted plan basis

PA compensation

PA tax withheld

Total Part B - Add the Pennsylvania columns

TOTAL - Add the totals from Parts A and B

Enter the TOTALS on your PA tax return on:

Line 1a

Line 13

Payment type: A. Executor fee

B. Jury duty pay

C. Director’s fee

D. Expert witness fee

E. Honorarium

F. Covenant not to compete

G. Damages or settlement for lost wages, other than personal injury

H. Other nonemployee compensation. Describe:

I. Distribution from employer sponsored retirement, pension or qualified deferred compensation plan

J. Distribution from IRA (Traditional or Roth)

K. Distribution from Life Insurance, Annuity or Endowment Contracts

L. Distribution from Charitable Gift Annuities

M. Distribution from Employee Stock Ownership Plan

Describe:

1501910051

1501910051

PRINT FORM

Reset Entire Form

RETURN TO TOP

1

1